The end of “Sunshine Saturday” signals a slowing of sales around the travel industry, but the stars are bright, and optimism reigns. March saw a decrease in global bookings of 6% from February, which followed a drop of 19.5% from January to February. But are we worried? Of course not!

The “new (post-pandemic) normal” is better than anyone had anticipated. As a result, March 2023 sits a full 26% higher than its 2019 (pre-pandemic) counterpart. The travel industry has proven to be remarkably resilient, and despite the troubles of recent years, the overall trend is positive.

The fact that March 2023 bookings are 26% higher than the same month in 2019 is a testament to the continuing appeal of travel and the industry’s ability to adapt and innovate in the face of adversity. As we look ahead to a bright future, there is every reason to believe that the travel industry will continue to thrive, offering us new and exciting opportunities for adventure and exploration.

The evidence for optimism is everywhere if you know where to look. For example, traveller infrastructure investment plans are being called for worldwide.

One such call is from Deutsche Bahn. The world-renowned German rail operator’s CEO, Richard Lutz, is forecasting 2023 passenger numbers to be “well over”; their previous pre-pandemic peak of 150.7 million riders and that, due to this, “renovation and modernization of rail infrastructure”; are necessary to keep the German railways more efficient and punctual. Better punctuality and efficiency for German trains? Who knew such a thing was possible!?

Another rally for investment is happening around the Middle East. By 2040 the Middle East and Asia-Pacific regions are expected to account for 58% of global air passenger demand. As a result, the CAPA – Center for Aviation concluded this week that Airports in the Middle East will need to invest a staggering $151 billion in capacity expansion as demand in the region is expected to double by 2040.

Megaprojects are already underway to handle this influx of travellers. For example, the UAE will complete its New Sharjah International Airport expansion by 2024. In addition, Kuwait Airport is expanding its passenger capacity to handle 13 million passengers per year. In Qatar, Hamad International Airport has broken ground on a terminal expansion which will improve its annual passenger capacity to more than 60 million. Saudi Arabia, not to be beaten, has announced the construction of one of the world’s largest airports which they hope will drive passenger traffic to 120 million by 2030, increasing to 185 million by 2050.

Airport investment isn’t contained only in the Middle East. For example, India’s largest private airport operator, Adani Airports, hopes to purchase at least a dozen additional airports in the country. The company’s CEO, Arun Bansal, stated, “India will have 1 billion air passengers by 2040, with passenger traffic growing at a compound annual growth rate of 8.5% over the next 20 years.”

India’s assent into a world travel powerhouse was also confirmed by Air India‘s announcement of a record-breaking order of 470 new jets from Boeing and Airbus. Not to be outdone by their competitors IndiGO, Air India’s main domestic competitor, also claims that a deal for an additional 500 jets is in talks.

As project after project is announced, it is clear that investors are confident that solid travel demand will continue well into the future.

More infrastructure demand surely means more demand for every other part of the industry, from restaurants and hotels to museums and souvenir shops. Everyone benefits from the extra capacity.

Let’s take a closer look at our hotel booking data to explain why investors are so confident about the future. The main news is that although the high sales of January have ended and currently sales are much lower, the year-on-year trends remain positive.

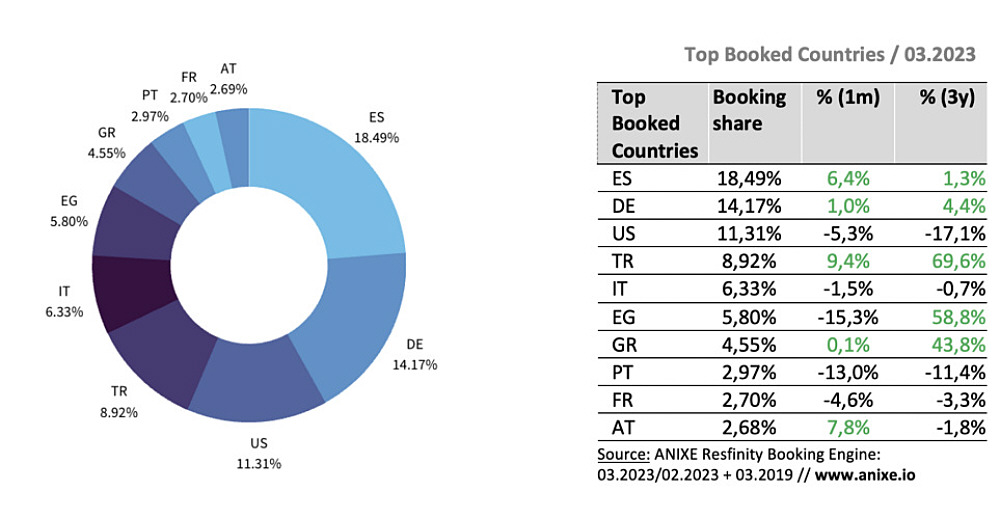

In March 2023, the wanderlust of German travellers persisted as they flocked to their all-time favourite destinations, with Spain, Turkey, the US, and domestic spots topping the charts. Turkey emerged as the rising star, boasting a near 10% increase in sales share for the month and a staggering 70% surge compared to pre-pandemic times. Egypt and Greece also revelled in the limelight, witnessing impressive growth of 59% and 44%, respectively, since the days before the pandemic.

But alas, not all destinations enjoyed the same fortune. America and Portugal, once beloved hotspots, experienced a noticeable dip in popularity – with demand plummeting by 17% and 11.5%, respectively. Month-over-month, Portugal and Egypt felt the sting of diminishing demand the most, seeing declines of 13% and 15.3%, respectively.

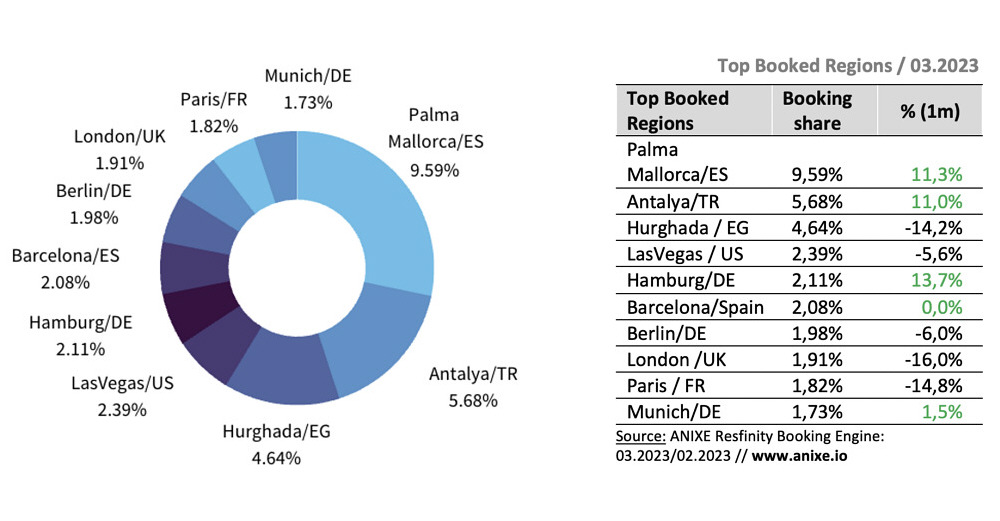

In the first month of 2023, jet-setters couldn’t resist the magnetic allure of Spain’s Palma Mallorca, Turkey’s Antalya, and Egypt’s Hurghada – clinching the top three spots for travel enthusiasts. However, Hurghada’s charm waned a tad, registering a substantial 14% dip in monthly popularity. In contrast, when viewed through the pre-pandemic lens, both Hurghada and Antalya dazzled with dynamic growth, skyrocketing by 60% and a whopping 160%, respectively, compared to 2019 figures.

On the flip side, London and Paris saw their glamour fade, experiencing steep declines in popularity on both monthly (16% and 14.8%, respectively) and three-year (33% and 8.9%, respectively) timescales. But fear not, as these iconic cities may very well reclaim their former glory and witness a resurgence in popularity down the line.

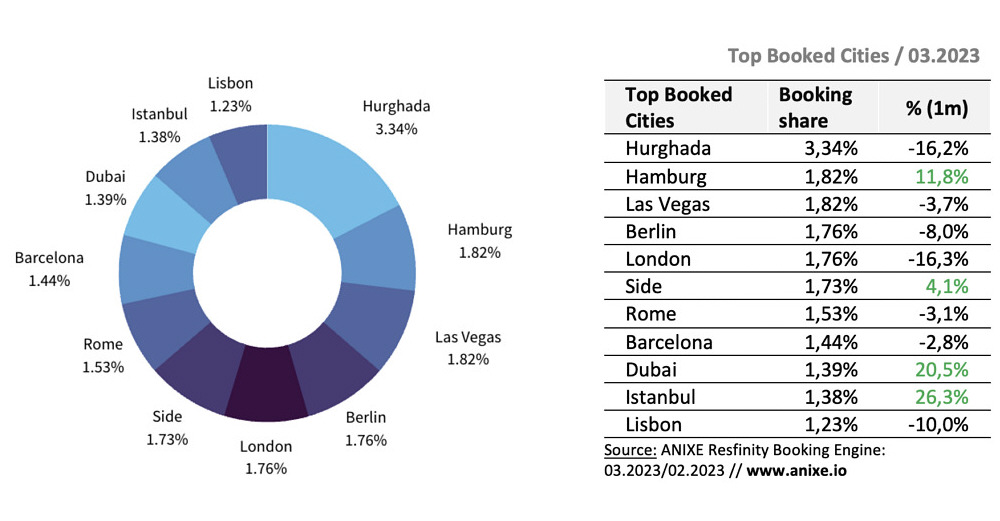

As March 2023 rolled around, German holidaymakers were attracted to Hamburg, yet the irresistible allure of Dubai and Istanbul also saw a remarkable 20% surge in interest. Hurghada, though experiencing a 16% dip in its recent share, still basked in the glow of popularity, boasting an impressive 33% uptick compared to the pre-pandemic days of March 2019.

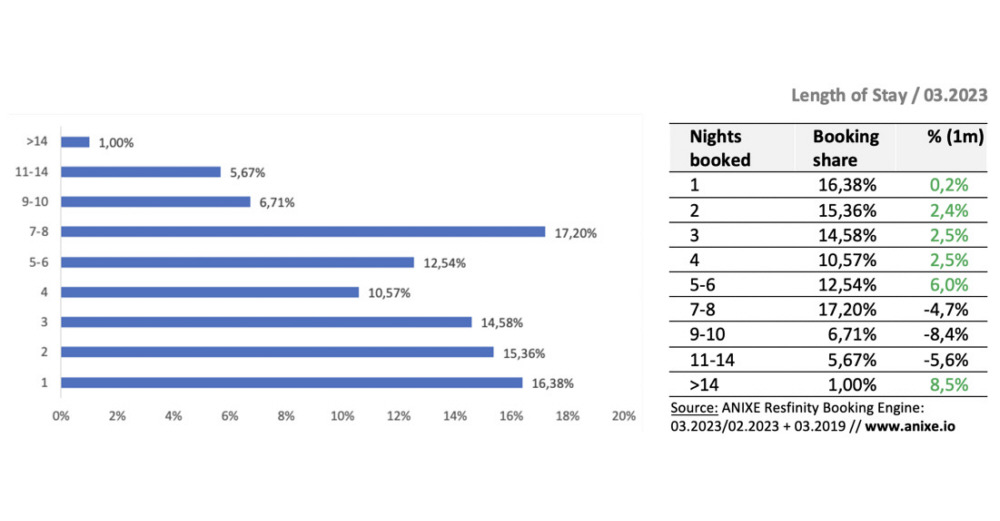

Short trips have always taken the lead for our travellers, whether it’s a whirlwind 1-2 day adventure or a leisurely week-long escape. This enduring lead persisted in the past month, with demand for short getaways even experiencing a gentle uptick. However, the appetite for these shorter journeys still has room to grow. One-day excursions remain 20% below pre-pandemic levels, and 2-4 day trips linger at a modest 10% shortfall compared to the high days of March 2019.

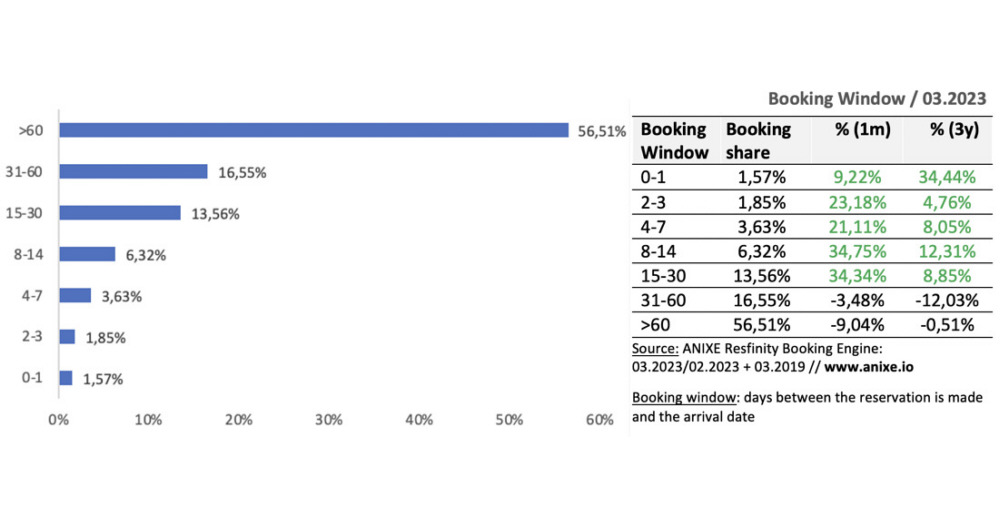

Eager to embark on their next escapade, German travellers in March 2023 were already setting their sights on future adventures, displaying a keen interest in securing bookings more than 60 days ahead of time. These forward-thinking reservations made up over 55% of all bookings, although they were 9% lower than in the previous period. This decline, however, was offset by a substantial 35% surge in the appeal of trips with an 8-30 day booking window. As for last-minute thrill-seekers (0-1), their share may be the smallest, but it remains a robust 35% higher than in the pre-pandemic era.

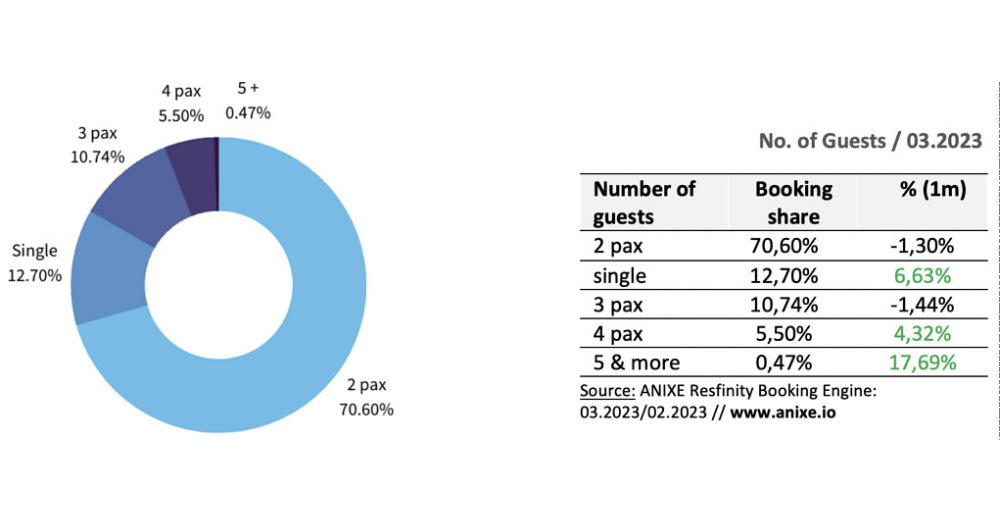

Month after month, Resfinity’s booking data reveals that dynamic duos and solo voyagers continue to dominate the travel scene. Meanwhile, single bookings are making bigger strides with a near 7% uptick compared to February 2023, though they still trail pre-pandemic figures by approximately 13.5%. Could a return to business travel be the cause, or do we simply have more lone wolves excited for adventure?

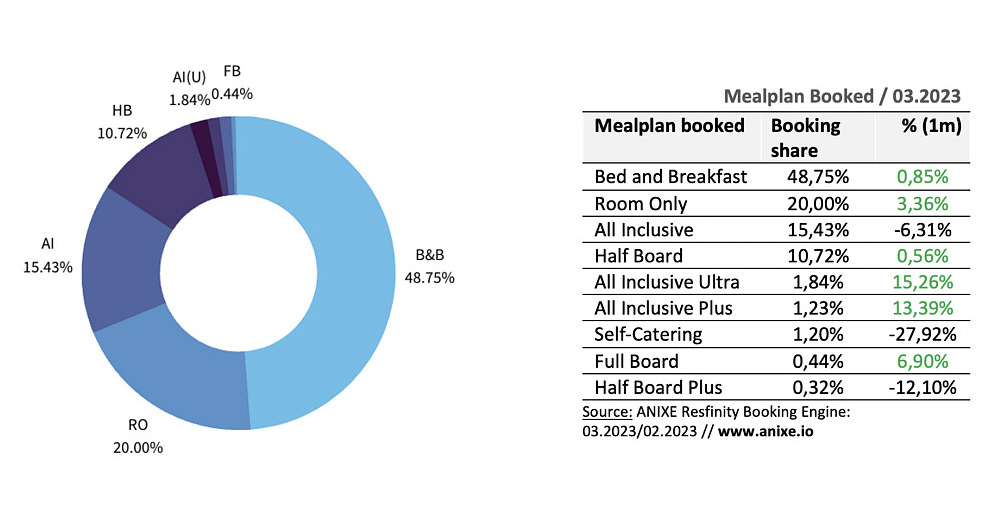

ANIXE’s Resfinity booking data uncovers a fascinating trend: single and double trips tend to gravitate towards accommodations offering breakfast or a no-meals option. As a result, rooms with Bed and Breakfast have been basking in the limelight, capturing a whopping 50% of sales last month. This impressive figure surpasses pre-pandemic rates by a solid 10%, making morning meals a traveller’s favourite!

Curiously, all-inclusive room bookings saw a dip last month, perhaps signalling the end of winter holiday indulgence.

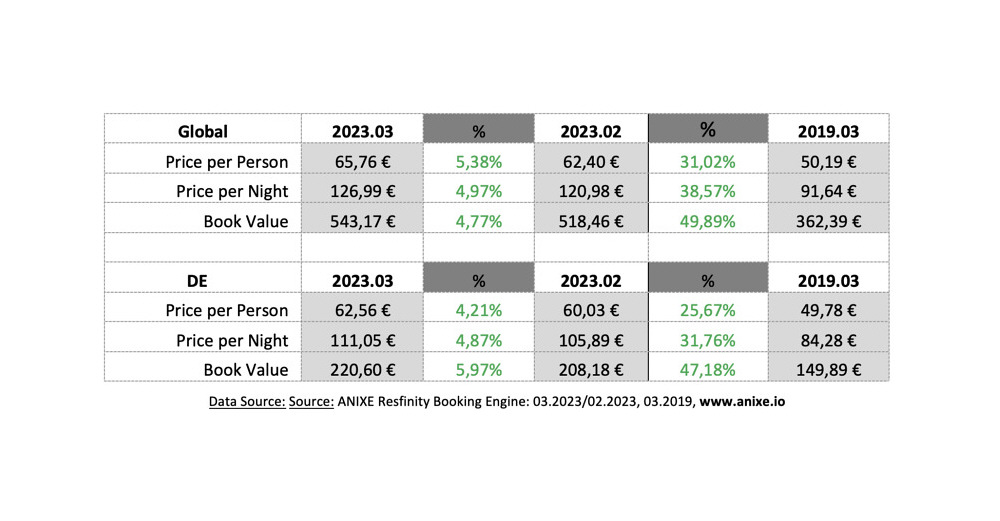

At the end of the summer high season, Resfinity’s data detected a subtle increase in prices within the German market. The culprits behind this uptick? A concoction of inflation, soaring fuel costs, and rising air transportation expenses. Fast forward to today, and per capita booking costs have skyrocketed by nearly 26% compared to only four years ago. Meanwhile, on the global stage, prices have surged by a staggering 31%. However, the burning question lingers: can this price hike last forever?

Although “Sunshine Saturday” has set, taking with it the warm glow of record-breaking sales, the stars are out and reading them fills us with optimism.

It seems like we have overcome the many challenges of recent years and are now looking ahead to the future growth of our industry.

With the increase in traveller infrastructure investment, the rise of new and exciting emerging markets, and an ongoing hunger for travel, there is every reason to get your hopes up.

Despite rising prices, demand remains strong, and the overall message is positive. As we adjust to this better-than-anticipated “new normal”, the travel industry’s capacity for innovation will undoubtedly play a key role in shaping its future success.

Data origin: ANIXE Resfinity Booking Engine. (Complete report available at anixe.io).

Data originated from the ANIXE Resfinity IBE system.

Tags: German rail operator, Richard Lutz, Deutsche Bahn, Adani Airports, Arun Bansal, CAPA – Center for Aviation, Air India, Boeing, Airbus, IndiGO, ANIXE