Airbnb’s unveiling last week of the splashy “Icons” experiences and a slate of new tools for group travel are both part of a much more fundamental element of the home-sharing platform’s future plans: to get more people to create profiles in its platform.

As Airbnb co-founder and CEO Brian Chesky explained to Wall Street analysts in a call to discuss the company’s first quarter 2024 financial results, “Right now, if you think of Airbnb as a solar system, the home is like the sun at the center of the solar system. I think in the future, the profile will be the center of the solar system of Airbnb, and the home will be one of many categories orbiting the profile.”

The launches last week are both fueling that strategy.

For Icons, anyone who wants to apply to book one of the 11 pop-culture driven experiences – with more scheduled to drop throughout 2024 – must create an Airbnb account and fill out a profile including residence and languages spoken. The profile form also asks applicants to answer at least one question from a list that includes "What do you do for work?" "Where did you go to school?" "Do you have any pets in your life" and more, and also requires the selection of at least three interests, such as "live music" "museums" "food" and "outdoors."

Chesky didn’t say how many people have already requested to book the five experiences that are currently available, but it's fair to assume it is quite a lot given that he did say the launch has generated more than 8,100 pieces of global media coverage and 371 million social media impressions.

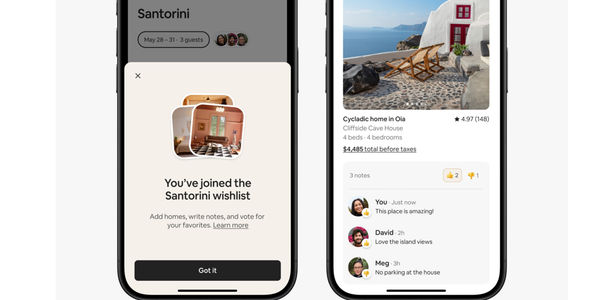

And then there are the new group travel tools. Chesky said more than 80% of bookings on the platform are for trips of at least two people, but traditionally only the person making the booking has a connected profile. Tools announced last week are meant to inspire everyone participating in the stay to create a profile so together they can share wishlists and review properties, communicate with hosts and see check-in details.

"It’s strategic for us to get more accounts … especially as you want to sell more things beyond homes,” Chesky said.

“We want to have a point of sale for every single person on the trip … not just a point of sale for the booker. … What we’re now doing is we’re going to be investing a lot more in increasing our profiles and our profile capabilities - our account structure, cleaning it up, our identity verification, getting more people to complete more robust profiles, increasing their preferences. So we have more information about people, and this is so strategic because as trust goes up, you can unlock more things for people. And as we know more about you, we can match you better.”

Chesky said that these efforts to expand Airbnb beyond its core function as a home-sharing platform, while the smallest of the company’s priorities in terms of financial and human resources devoted to it, is where he and his leadership team are spending the majority of their time.

“[We are] focused on transforming the company from an accommodations business to a … multi-category company, and over the next three years you’re going to see this play out quite substantially.”

And Chesky said the Icons products are intentionally positioned as experiences - although some do include an overnight stay - because they are part of the goal to expand the company’s brand positioning beyond “just a place to stay.”

"Icons is like we’re a car company and we’re starting with a Formula One car,” Chesky said.

“And very few people can experience a Formula One car, but it captures the magic, it captures the demand. It really expands the brand and increases our permission to be able to go into experiences, and then you kind of move down market. And one of our goals is going to be to bring the magic of Icons to everyone. ... We’ve really paved the way for next year.”

International growth and improving the core

Last week’s launch event also tied into another of Airbnb’s priorities – international expansion. As it hosted more than 150 journalists and influencers from around the world at the one-day event in Los Angeles, Airbnb was investing in brand awareness in countries such as Mexico, Brazil, Germany, India, China, Japan and Korea - some of the 220 countries where the company operates and which Chesky said are key priorities for growth.

“A lot of these other markets … are huge travel TAMS [total addressable markets], especially in Asia,” he said.

“And one of the things that we’ve learned is that Airbnb pretty much resonates pretty equally everywhere once there is the awareness. … So I’m very, very bullish about that.”

A third priority for the company relates to perfecting its core business. Chesky said he believes the company is “just scratching the surface” in its ability to improve three things: the quality and reliability of its products; the affordability of what it offers compared with competitors; and the usability of its platform.

One notable metric that speaks to progress in terms of user experience is the fact that Airbnb’s app downloads in the United States increased 60% in Q1 compared with the same period a year ago, and global nights booked through the app increased 21% year over year, to 54% of total nights booked in the quarter, up from 49% in Q1 2023.

Chesky noted that conversion rates on native apps are typically much higher than on a mobile website. In addition, improvements that have been made to the user interface, such as better filters and a more prominent search box, have “over the last year, last 12 months, we’ve likely driven at least a few hundred basis points of incremental growth just through optimization of the search flow,” he said.

Financial results

While it remains to be seen what impact Icons has on the company’s bottom line – there’s speculation across the industry it won’t be much and Chesky himself acknowledged it is a brand investment – Airbnb’s Q1 results show momentum in the home sharing platform’s growth.

Revenue in the first quarter hit $2.14 billion, up 18% year over year, while adjusted EBITDA of $424 million represented a 20% adjusted EBITDA margin, up six percentage points from the prior year.

Nights and experiences booked in the first quarter of this year grew to 133 million, up 9.5% year over year, with growth reported in all regions of the world. Compared with the same quarter in 2023, active listings for accommodations - excluding thousands of properties that Airbnb removed for low quality – grew 17%.

The company said the highest growth in inventory came in Asia Pacific and Latin America, regions that also had the highest year-over-year growth in nights and experiences booked.

Tags: Airbnb, Brian Chesky, bookings, Alternative Accommodation