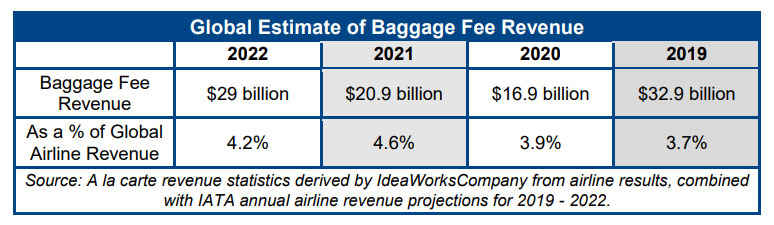

DUBLIN, IRELAND & SHOREWOOD, WISCONSIN – IdeaWorksCompany, the foremost consultancy on airline ancillary revenues, and CarTrawler, leading global B2B provider of car rental and mobility solutions to the travel industry, recently estimated ancillary revenue at $102.8 billion worldwide for 2022. This CarTrawler Global Estimate of Baggage Fee Revenue identifies baggage as a $29 billion component and provides a summary of baggage fee policies for 20 top airlines.

Each year IdeaWorksCompany analyzes the ancillary revenue disclosures for airlines all over the world. These results are applied to a larger list of carriers (which numbered 122 for 2022) to estimate ancillary revenue activity for the world’s airlines. Baggage activity for each category of airline is added to this analysis to calculate a global estimate. It’s a significant component of ancillary revenue and consists of three primary sources: checked baggage in the aircraft hold, added fees for heavy and extra-large bags, and for some airlines, the price charged for larger carry-on bags.

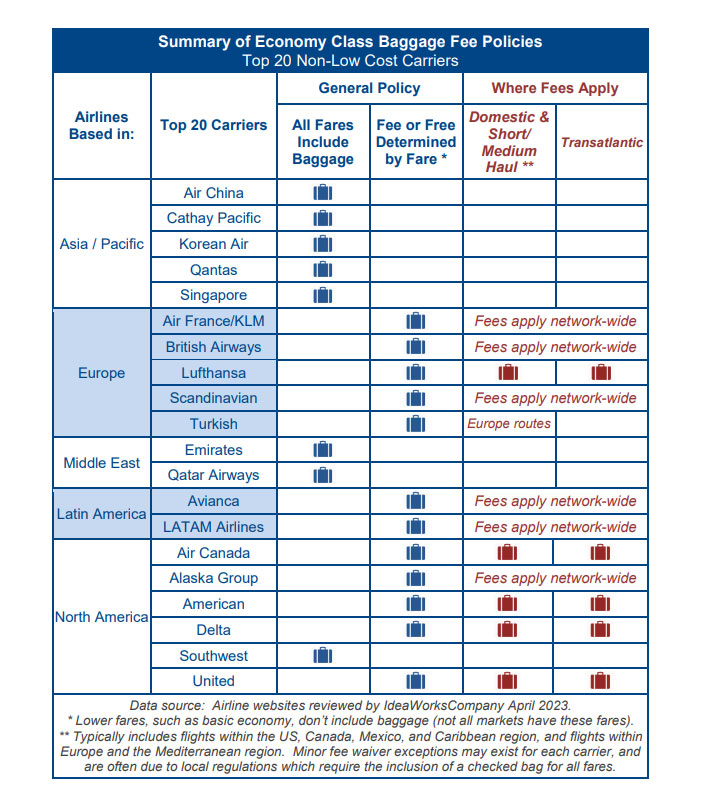

Baggage fees are now a regular revenue source for airlines in Europe, North America, and Latin America. For global network carriers, these are typically associated with “basic economy” fares; for low cost carriers, baggage fees are typically charged to all consumers.

“It’s great to see that baggage fees are such a key ancillary revenue driver for airlines, with a significant increase from 2021 to 2022 of just over $8 billion,” says Aileen McCormack, Chief Commercial Officer, CarTrawler. “At CarTrawler, we know the importance of ancillary revenue for our partners, and how providing the right product to the right customer at the right time is key to optimising these revenues, while providing the best possible customer experience.”

The table on the next page lists the baggage fee policies for 20 top non-low cost carriers, which 16 years ago would’ve displayed all as including checked baggage for all fares. Today, the competitive pressures brought by low cost carriers have reduced the list to just eight airlines which continue to include checked baggage as a feature for all fares.

The adoption of baggage fees continued in the last year with Turkish Airlines adding its EcoFly fare on routes between Turkey and Europe. This is the carrier’s first basic economy-style fare which excludes checked baggage and seat assignment, in exchange for a lower fare for consumers. Baggage fees are also appearing in business class. Finnair introduced Business Light fares during the pandemic, which are priced below its Classic business fare in Europe and Asia markets. The fare does not provide checked baggage; travelers may bring the usual 2 carry-on bags, similar to the Classic business fare.

The pandemic did not bring sweeping changes to baggage policies among global network carriers based in Africa, Asia, or the Middle East. But this will change as low cost carriers become more prevalent in these regions. Europe’s low cost carriers flew approximately 38% of Europe-based airline traffic for 2021. Within Asia, this statistic drops to 23%, because the region has less low cost airline activity. The arrival of baggage fees represents good news for consumers, because it’s an indicator of robust competitive behavior between traditional and low cost carriers. Look for more global network airlines in Asia and the Middle East to gradually adopt a stronger a la carte approach.

Ancillary revenue from baggage fees will continue to grow and 2023 results will likely surpass the record $32.9 billion reached in 2019. Baggage is a reliable revenue stream which easily surpasses 4% of total airline revenue. While economic conditions cause air fares to swing up and down, baggage revenue is isolated from these fluctuations. The share of total industry revenue held by baggage activity was estimated to drop to 4.2% from last year’s level of 4.6%. This can be attributed to larger gains made by other ancillary revenue activities such as seat assignment fees and co-branded credit card programs. But the trend is abundantly clear ─ baggage fees, be they assessed for checked bags, large carry-ons, or included as part of a bundle, are a crucial component of profitability for nearly every airline.