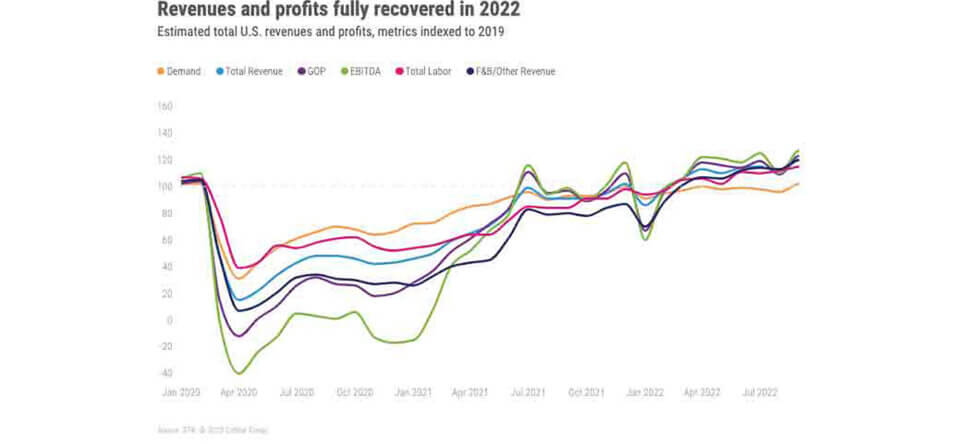

2022 estimated totals

Revenue: $239.7 billion

GOP: $101.3 billion

EBITDA: $74.8 billion

Labor: $70.9 billion

2022 per-available-room metrics (% change from 2019)

GOPPAR: $73.70 (-5.5%)

TRevPAR: $202.23 (-4.3%)

EBITDA PAR: $52.20 (-5.6%)

LPAR (Labor Costs): $65.94 (-7.6%)

“Total revenues and profits surpassed 2019 levels due to strong demand, tremendous pricing power influenced by inflation and increased revenues from other departments,” said Raquel Ortiz, director, financial performance, STR. “The metrics also improved on a per-available room basis as the year went on. Labor costs grew at a compound monthly rate of 3.7% as hotels maximized their staffing hours and paid out more to contract workers. At the same time, that contract labor played into profit margin growth because of the savings realized in benefits. F&B revenues have yet to recover to 2019 levels, with catering & banquets as the laggard due to the gap in group and corporate demand.”

Seven of the major markets realized both GOPPAR and TrevPAR levels higher than the 2019 comparables.

“GOPPAR and TRevPAR have continuously improved across all major markets. Those at the top and bottom ends of the recovery scale have also stayed the same, with beach/warmer destinations at the top while more urban/business-centric markets remain at the bottom,” Ortiz said

Tags: Raquel Ortiz, STR