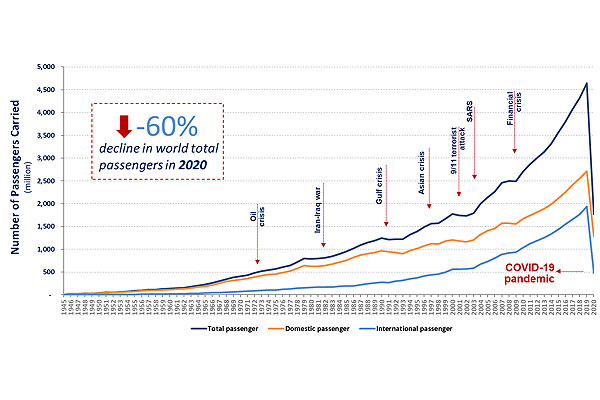

ICAO reports that as seat capacity fell by 50 percent last year, passenger totals dropped by 60 percent with just 1.8 billion passengers taking to the air during the first year of the pandemic, compared to 4.5 billion in 2019.

Its numbers also point to airline financial losses of 370 billion dollars resulting from the COVID-19 impacts, with airports and air navigation services providers (ANSPs) losing a further 115 billion and 13 billion, respectively.

The pandemic plunge in air travel demand began in January of 2020, but was limited to only a few countries. As the virus continued its global spread, however, air transport activities came to a virtual standstill by the end of March.

With the wide-scale lockdown measures, border closures, and travel restrictions being set out around the world, by April the overall number of passengers had fallen 92 percent from 2019 levels, an average of the 98 percent drop-off seen in international traffic and 87 percent fall in domestic air travel.

Subsequent to the April low point being reached, passenger traffic saw a moderate rebound during the summer travel period.

That upward trend was short-lived, however, stalling and then taking a turn for the worse in September when the second wave of infection in many regions prompted the reintroduction of restrictive measures.

Sectoral recovery became more vulnerable and volatile again during the last four months of 2020, indicating an overall double-dip recession for the year.

Disparity between domestic and international recoveries

ICAO also reported that there has been a persistent disparity between domestic and international air travel impacts resulting from the more stringent international measures in force.

It said that domestic travel demonstrated stronger resilience and dominated traffic recovery scenarios, particularly in China and the Russian Federation where domestic passenger numbers have already returned to the pre-pandemic levels.

Overall there was a 50 percent drop in domestic passenger traffic globally, while international traffic fell by 74 percent or 1.4 billion fewer passengers.

As of late May 2020, the ICAO Asia/Pacific and North American regions led the global recovery in passenger totals, largely due to their significant domestic markets. Europe saw a temporary rebound but trended downward dramatically from September. Latin American and Caribbean traffic saw improvements in the fourth quarter, while recoveries in Africa and the Middle East proceeded less robustly.

World passenger traffic evolution 1945 – 2020

Financial distress and grim outlook ahead

Paralyzed revenue streams resulting from the plunge in air traffic has led to severe liquidity strains across the aviation value chain, placing the industry’s financial viability in question and threatening millions of jobs around the world.

Cascading impacts have also been severe across tourism markets globally, given that over 50 percent of international tourists formerly used air travel to reach their destinations.

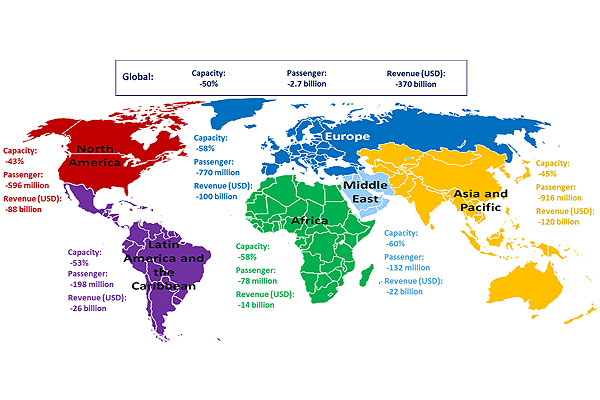

The global 370 billion dollar drop in gross airline passenger operating revenues represented losses of 120 billion in the Asia/Pacific, 100 billion in Europe, and 88 billion in North America, followed by 26 billion, 22 billion and 14 billion in Latin America and the Caribbean, the Middle East and Africa, respectively.

ICAO indicated that the near-term outlook is for prolonged depressed demand, with downside risks to global air travel recovery predominating in the first quarter of 2021, and likely to be subject to further deterioration.

It expects any improvement in the global picture only by the second quarter of 2021, though this will still be subject to the effectiveness of pandemic management and vaccination roll out.

In the most optimistic scenario, by June of 2021 passenger numbers will be expected to recover to 71 percent of their 2019 levels (53 percent for international and 84 percent for domestic). A more pessimistic scenario foresees only a 49 percent recovery (26 percent for international and 66 percent for domestic).

ICAO continues to provide recommendations and support for the aviation sector to weather through the crisis. Its new Guidance on Economic and Financial Measures summarizes a range of measures that can be explored by States and the industry to alleviate the imminent liquidity and financial strain and to strengthen the industry’s resilience to future crises.

2020 passenger traffic and revenues, by region