BROOMFIELD, COLORADO - STR‘s latest monthly P&L data release shows U.S. hotel gross operating profit per available room down 105.4% in June. That year-over-year percentage change showed continued improvement from April (-116.9%) and May (-110.1%). Additionally, some full-service properties broke even with occupancy at 50%, one month after limited-service properties showed positive profitability on average when surpassing 45% occupancy.

In a year-over-year comparison with June 2019, the industry reported the following:

- GOPPAR: -105.4% to US$-5.89

- TRevPAR: -81.3% to US$46.95

- EBITDA PAR: -124.6% to US$-20.85

- LPAR (Labor Costs): -59.6% to US$31.21

“Aligned with the rise we’ve reported in demand and occupancy, the profitability metrics picked up further with improvements across all revenue departments except F&B,” said Raquel Ortiz, STR’s assistant director of financial performance. “On a per-available- room basis, revenue for full-service properties almost matched the level of limited-service. Overall, full-service GOPPAR was still negative although we did see some properties in that segment break even at 50% occupancy.”

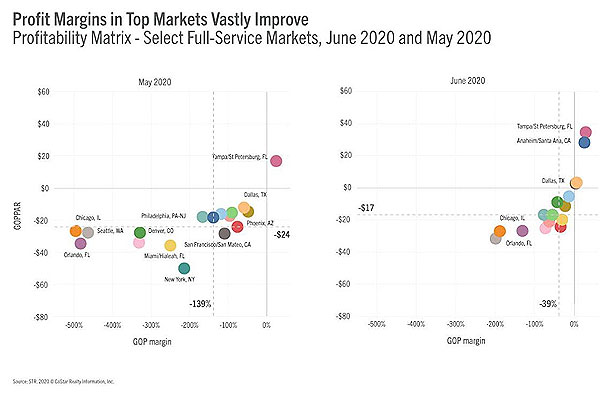

Among top markets, the highest TrevPAR and GOPPAR levels were recorded in Tampa/St. Petersburg, Florida (TrevPAR: US$116, GOPPAR: US$35) and Anaheim/Santa Ana, California (TrevPAR: US$110, GOPPAR: US$28).

“Given the trends we’ve seen in occupancy data, it is no surprise that two beach-access markets would lead in overall profitability for the month,” Ortiz said. “Fortunately, all the top markets showed improved revenues in June, but Tampa and Anaheim were the only ones with positive EBITDA margins.”

Tags: STR