NEW YORK, NY – One of the biggest financial roadblocks on the way to retirement may be your adult children, according to a new Bankrate.com report. In fact, half of American parents with adult children say supporting their grown kids has been detrimental to their retirement savings, and more than 1 in 6 (17%) says it has had a significant impact.

The Bank of Mom and Dad feels the pinch when it comes to retirement contributions. Higher earners with adult children are more likely to sacrifice their retirement savings, while lower earners are more prone to have never saved for retirement at all. Sixty percent of those with adult children and a household income of $80k+ said they’ve jeopardized their retirement savings for their adult children’s bills. More than 1 in 6 (17%) making less than $50k per year with at least one child 18 or older aren’t saving anything at all.

“Addressing the financial elephant in the room isn’t always an easy conversation to have but it is imperative for your future and your child’s long-term success,” says Kelly Anne Smith, analyst at Bankrate.com. “By not prioritizing your own expenses and retirement savings, that is when everyone suffers.”

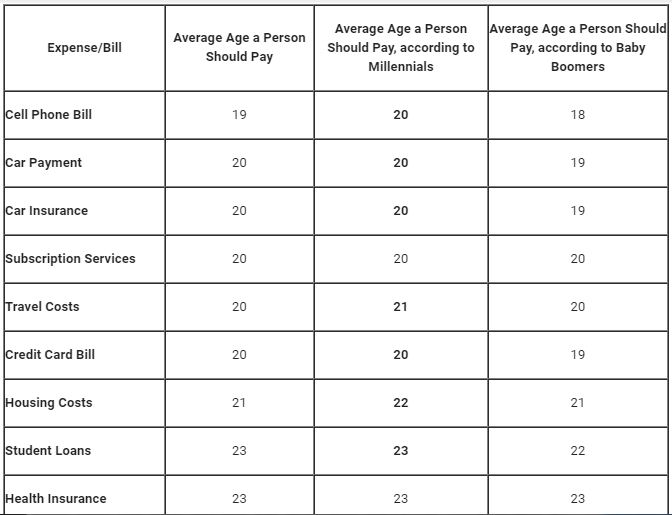

From paying car insurance and student loans to credit card bills, parents could still be giving money to their children for plenty of expenses. In general, 19-23 years old are the most common ages for a parent-funded lifestyle to be expected to end. Shockingly, Millennials (ages 23-38) believe the cut-off age should be delayed in many cases while Baby Boomers (ages 55-73) believe the earlier the better.

“Setting clear boundaries and creating a game plan for your children are a couple ways to wean them off your wallet, so you can focus on your future financial security and they can learn to be financially independent” says Smith.

Methodology: Bankrate commissioned YouGov Plc to conduct the survey. All figures, unless otherwise stated, are from YouGov Plc. Total sample size was 2,553 adults, including 890 adults with at least one child 18 or older. Fieldwork was undertaken on April 3 – 5, 2019. The survey was carried out online. The figures have been weighted and are representative of all U.S. adults (aged 18+).

See the survey .