Travel companies are transforming into financial services platforms, banks are morphing into travel agencies and loyalty programs are becoming sophisticated investment vehicles. It's like watching three separate chess games merging into one impossibly complex board.

The U.S. market's unique advantage in this space stems from the interchange arbitrage opportunity versus the EU's 0.3% interchange fee caps. U.S. airlines can capture 1%-3% per transaction, funding those attractive mileage benefits that European carriers can only dream about.

From loyalty to lifestyle integration

The most significant shift involves expanding beyond transactional relationships toward lifestyle integration. Modern travel finance products aim to capture spending across categories that correlate with travel behavior: dining, entertainment, gas stations and groceries. This represents a fundamental shift in understanding of consumer psychology—the recognition that travel affinity extends far beyond the moments when you're actually booking flightstraditional banking products aren't. When customers spend time accumulating travel points, switching costs between financial institutions increase exponentially.

The strategic divide: Co-branded cards reach vs. proprietary cards depth

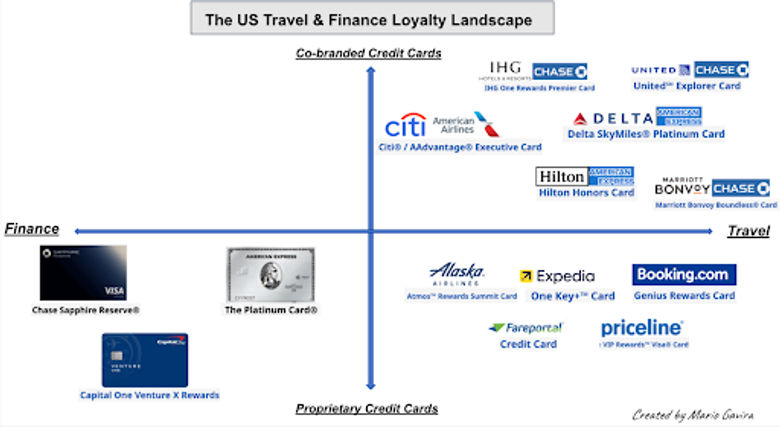

The travel rewards landscape is primarily shaped by two distinct, yet interconnected, financial product models: co-branded credit cards and general travel cards with transferable points.

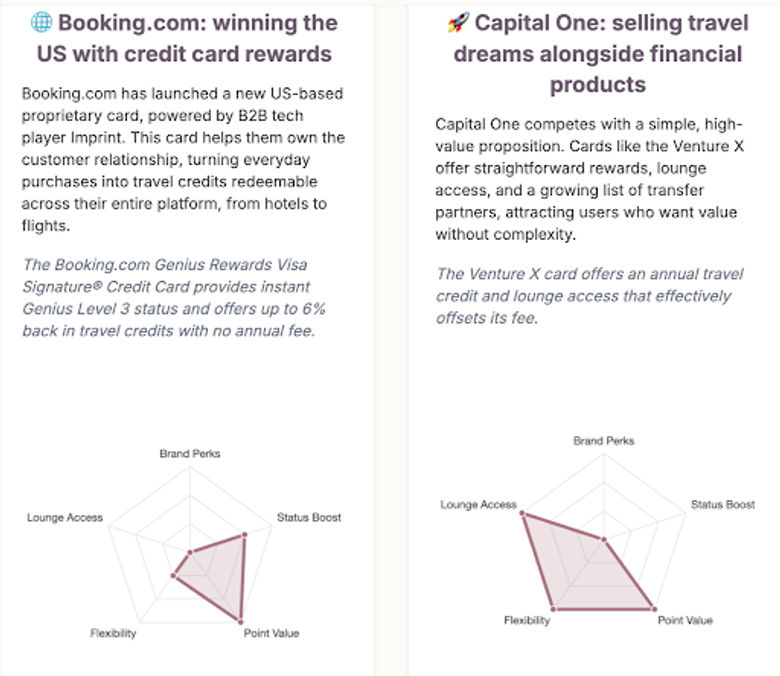

The first is a proprietary path, where brands build their own direct-to-consumer financial products powered by B2B enablers. For financial institutions like Capital One, this means partnering with a company like Hopper's B2B division (HTS) while Booking.com leveraged fintech startup Imprint to issue their own branded credit card. It's a closed-loop system that helps these brands to acquire and retain customers within their own ecosystem.

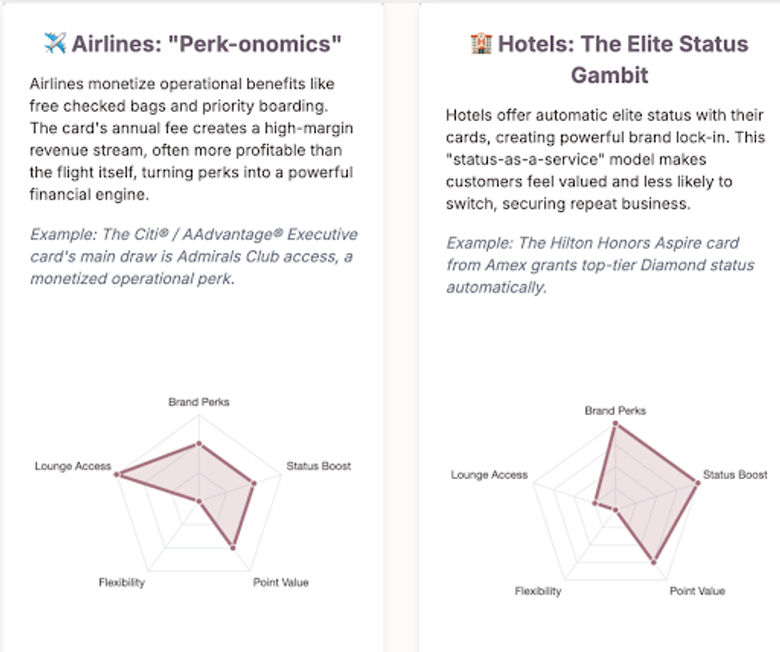

The second, more traditional strategic choice is the co-branded model, which leverages the complementary customer segments of both a financial institution and a travel provider. In this model, the bank benefits from a new distribution channel and access to a travel brand's loyal customer base while the travel company gains a high-margin revenue stream and a powerful tool for customer retention. It’s a win-win symbiotic relationship.

In the end, the big financial players like Chase and Amex don't just pick one path.They play both sides, offering a mix of their own cards and a whole portfolio of co-branded options to appeal to different traveler segments.

Strategic implications: The future battlefield

The competitive dynamics are reshaping along multiple dimensions simultaneously. Airlines now compete on financial products alongside routes and service quality. Hotels compete with banks for customer financial relationships. Banks compete with travel agencies for booking revenue.

For travel brands, the strategic options have crystallized into several distinct paths:

- Niche premium positioning: Focus on specialized traveler segments with curated, experiential rewards rather than broad-market appeals. Marriott Bonvoy's Bellagio fountain programming and Hilton's private artist showcases exemplify this approach.

- Strategic integration partnerships: Develop co-branding relationships with shared objectives rather than pure white-label arrangements that erase brand identity

- Flexible currency systems: Implement split tender capabilities (cash-plus-points) and more accessible, frequent rewards to counter elite status oversaturation

For fintech platforms, the opportunity lies in becoming the invisible infrastructure layer—developing modular Software-as-a-Service solutions for dynamic pricing, personalized offers and artificial intelligence-driven loyalty optimization.

The data advantage: Predicting intent before awareness

The ultimate prize in this convergence isn't interchange fees or interest income—it's predictive customer intelligence. When a travel company has visibility into complete spending patterns, they can predict travel behavior with unprecedented accuracy. They know you're likely to book a trip before you've consciously decided to travel.

This transforms marketing from reactive demand capture to proactive intent nurturing. Instead of competing for attention when customers start shopping, these platforms can identify and cultivate travel desires before they fully form.

The new rules of engagement

The travel industry's embrace of embedded finance represents a fundamental reimagining of customer relationships. Traditional boundaries between airlines, hotels, banks and technology platforms have blurred beyond recognition. The ultimate vision involves travel companies function as comprehensive lifestyle platforms, with financial services as the connective tissue between various consumer touchpoints.

The new travel money game has begun, and the rules are still being written. The winners will be those who succeed in the seamless integration of travel expertise with financial services capabilities, creating experiences and rewards that feel unique to your brand.

The only certainty? Your wallet is about to get a lot more interesting.