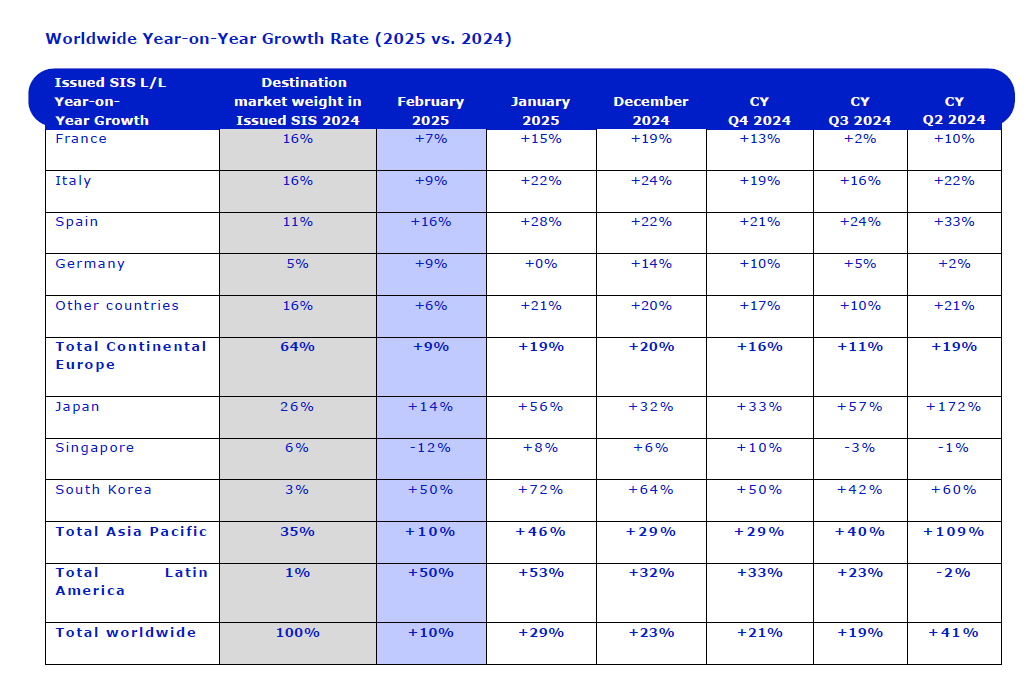

New data from Global Blue reveals double-digit growth in Tax Free Shopping across Continental Europe and Asia Pacific, with Issued Sales in Store (like-for-like year-on-year performance) at +10%1 in February 2025, compared with +29% in January.

A solid performance in Continental Europe despite negative calendar effects

In Continental Europe, the issued Sales in Store increased by +9%1 in February 2025 compared with +19%1 in January, impacted by one less retail day and the shifts of Lunar New Year and Ramadan. This performance was driven by a +9%1 increase in the number of shoppers, while the average spend per shopper remained stable at 0%1. Among key origin markets, US Tax Free Spend led the growth at +23%1 vs. last year and European Non-EU shoppers also recorded +23%1 growth. Meanwhile, GCC shoppers’ Tax Free spend softened to +21%1 versus +30% in January, reflecting the ten-day shift at the beginning of Ramadan, with a positive impact expected in April 2025. Mainland Chinese shoppers Tax Free Spend softened by -11%1 versus +1%1 in January, driven by the Lunar New Year shift. Regarding destination markets, February saw sustained performance across key European markets: Spain at +16%1, Germany at +9%1, Italy at +9%1, and France at +7%1.

A strong performance in Asia Pacific despite negative calendar effects

In Asia Pacific, the issued Sales in Store growth reached +10%1 in February 2025, marking a softening compared to January 2025 (+46%1), impacted by one less retail day and the shift of the Lunar New Year holidays. This performance was driven by a +17%1 increase in the number of shoppers and a -6%1 rise in the average spend per shopper.

Among key origin markets, Mainland Chinese Tax Free Spend led the growth at +19%1 versus +87% in January, impacted by the Lunar New Year shift. Hong Kong and Taiwan shoppers’ Tax Free Spend displayed a similar dynamic, softening to -11%1 versus +22% in January, while North East Asia shoppers’ Tax Free Spend also softened by -34%1 versus -2% in January.

Regarding destination markets, Global Blue finds that February saw sustained performance across key Asia Pacific markets: South Korea at +50%1, Japan at +14%1, and Singapore at -12%1.

1 Growth rate variation year-on-year (2025 vs. the same period in 2024)

2 Lunar New Year took place from February 3 to February 18 in 2024 and from January 25 to February 9 in 2025. Ramadan took place from March 10 to April 9 in 2024, and will take place from February 28 to March 30 in 2025

Taqs: Global Blue