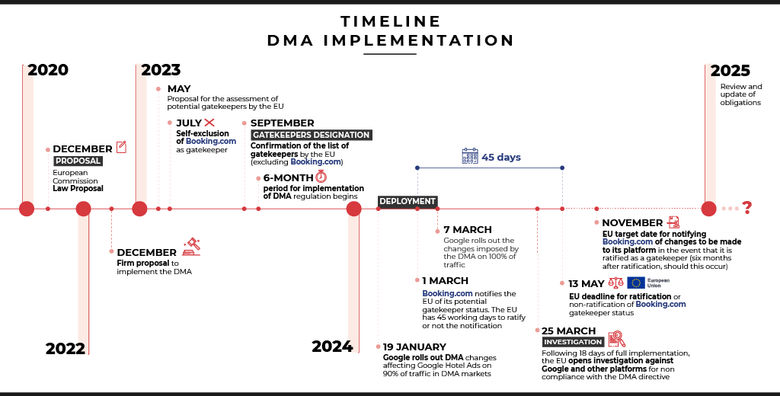

Following several months of adaptation, on January 19 Google began to roll out changes it made in order to comply with the European Union’s DMA (Digital Markets Act) requirements; a rollout that finished on March 7.

Just days after the first changes were implemented, we began to see how they influenced hotel campaigns in Google Hotel Ads. Three months on, results for hotels are still getting worse:

Just over three months following implementation, click-through data has shown a 30% decrease in traffic volume in EU markets affected by DMA implementation compared with those markets where DMA has not been implemented.

The graph below shows the Google Hotel Ads click differential between regions affected by the DMA vs. those not affected, revealing a click volume drop of 30%. This is based on our comparison of traffic volume of 3,450 hotels from January 1 through April 22.

The volume of direct bookings drops as much as 36%, increasing hotel dependence on intermediaries, which seriously damages their profitability.

What has changed exactly?

Basically, Google has been obliged to alter its results scheme for travel searches (flights and hotels). Here we will focus only on changes that have affected hotels.

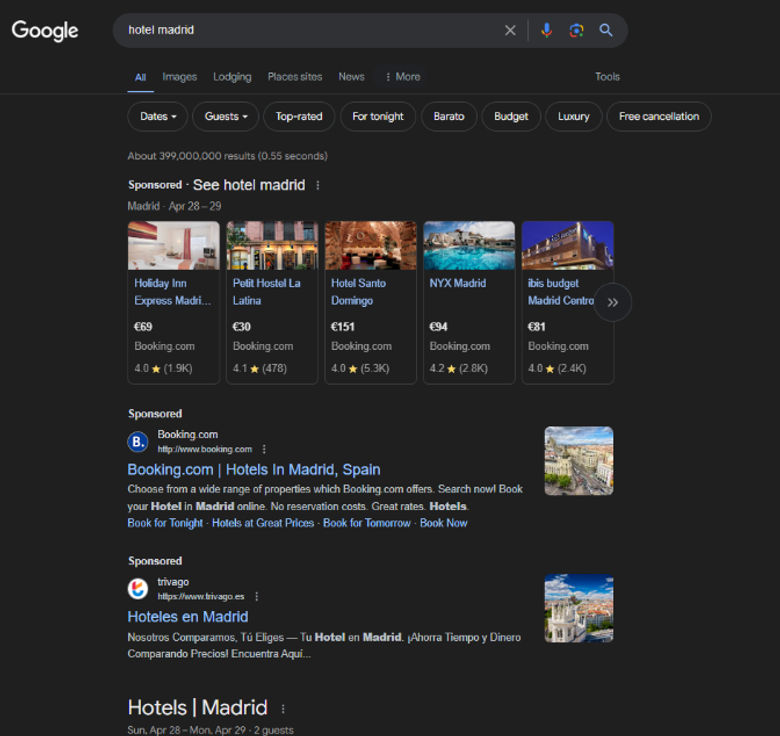

- BEFORE (and currently in markets outside the EU):

- NOW (implemented in the 27 EU markets):

Background

In July 2023, the European Union designated six digital companies as gatekeepers, Amazon, Apple, ByteDance (TikTok), Alphabet (Google), Meta (Facebook) and Microsoft, on the basis of the relevance of the 22 platforms operated by these companies.

In the case of Google, the gatekeeper designation means it cannot include its own vertical services (Google Maps, Google Flights or Google Hotel Ads) in its search results pages (known as SERPs). The specific article in question is Article 6.5 of the DMA, which deals with “self-preferencing”:

“The gatekeeper shall not treat more favorably, in ranking and related indexing and crawling, services and products offered by the gatekeeper itself than similar services or products of a third party. The gatekeeper shall apply transparent, fair and non-discriminatory conditions to such ranking.”

This means that presentation of hotel offers to users based in DMA markets is less organized, clear and intuitive.

Prior to the DMA, Google’s taxonomy of results was the result of decades of effort by the company to refine its results in order to provide an optimized search experience that would connect supply and demand in a way that was ideal for both.

This pre-DMA search experience offered hotels participating directly in the Google Hotel Ads product the option to present their inventory (availability and room rates) in a way that was both efficient from the standpoint of distribution cost and enriched for the user, as it integrated the experience of other services, e.g. Google Maps.

This way of presenting information was clear, relevant and intuitive, and maximized purchasing decisions such as hotel bookings for those users who were so inclined.

What has been lost with the implementation of the DMA?

The user can no longer:

- View the hotel offer at the destination (availability and prices in aggregate).

- Click on the Google Maps link to locate the hotel. This point is particularly frustrating.

- View the “hotel package” (selection of three hotels with availability, price and user ratings) in which both hotels with websites and intermediaries could participate.

- Change the dates and other booking elements, such as the number of travelers per room (these are updated in the search engine and not in the hotel file), in an easy, user-friendly way during the booking process.

- View calendar prices.

- Easily access the Google Travel environment for more comprehensive travel information.

- Clicking on “Book a room” opens search engine results, rather than the Travel section.

- Instead of clicking on the price, the user must click on “Visit Site.”

- All interactions with the form modify the search engine results (SERP).

From the hotel perspective:

The hotel has lost visibility in terms of the user experience, which can be proven as follows based on our comparison of traffic volume of 3,450 hotels between DMA and non-DMA markets from January 1 through April 22:

- 30% drop in clicks to websites in markets affected by DMA.

- 36% drop in direct bookings in markets affected by DMA.

While we cannot affirm the fate of these “lost clicks,” given that existing demand is a zero-sum game the most plausible hypothesis is that the difference in clicks in DMA markets is being captured by those advertisers that have gained visibility and prominence in the new results format, these being intermediaries such as online travel agencies (OTAs) such as Booking.com and Expedia, mainly.

Booking.com is now a gatekeeper

On Monday, the European Commission designated Booking.com as a gatekeeper. This comes after Booking notified the EU of its potential gatekeeper status in March. Here is how the events have unfolded.

Booking.com now has six months to submit a detailed compliance report. On receiving the report in mid-November, the EU will notify Booking.com of any changes to be made to its platform.

What does this mean for the hotel industry?

The key result of the implementation of the DMA for hotels is that they have lost visibility in the markets affected by the DMA and as such they have lost direct sales capacity, their profitability has been reduced and their dependence on intermediaries increased.

The EU, in its efforts to make the DMA a fairer, more balanced market, is obliging gatekeepers to adapt to the regulation. As a result, these changes are subjecting hotels to the toll of intermediation, strangling direct sales and holding users and hotels captive to less profitable, less independent business models.

Now that Booking.com has been ratified as a gatekeeper, it remains to be seen what measures are imposed and the consequent degree of compliance. In any event, assuming they prove restrictive and favorable to the hotel industry, Booking.com would have gained more than a year’s competitive advantage by enjoying the increased visibility afforded by the changes imposed by the DMA since January 2024.

Who stands to gain from all this?

In theory, the user should be the primary beneficiary of implementation of the DMA.

Today, the user experience on the Google hotel search results page is less clear, less intuitive and requires a higher number of clicks, thus “pushing” the user to purchase through intermediaries a service that previously could be purchased directly from the producer with greater clarity, ease, competitiveness and efficiency for all concerned.

We should not forget that, in the event an in-house marketing strategy exists (a transactional website allowing booking), the best source for a service/product is always the producer, assuming the service/product is marketed properly and coherently.

OTAs, in particular Booking.com due to its presence and relevance in Europe, are gaining even more visibility and prominence in Google search results since the DMA has been rolled out. It is difficult to determine precisely, but a substantial part – if not all – of the 30% of clicks lost by hotels are going to intermediaries.

Will the EU impose an equivalent restriction or change of practice on Booking.com?

It is difficult to anticipate what will happen. The EU took an asymmetrical approach to the interpretation of its own rules by excluding Booking.com from the first group of designated gatekeepers.

While the EU has finally ratified Booking.com as gatekeeper, any limitations it might impose on the OTA are unlikely to take effect before the end of 2024. As we cannot know the scope of these changes, the only certainty we have is that Booking.com will have enjoyed at least eleven months of competitive advantage as a result of the EU’s erratic application of the DMA.

The remaining intermediaries (Expedia and others) could continue to enjoy the competitive advantage derived from non-gatekeeper status forever.

It is worth noting that the EU’s current implementation of the DMA favors large companies based in the United States, such as Booking Holdings or Expedia Group, while harming the European user experience by reducing the profitability and competitiveness of the hotel ecosystem, especially for smaller independent chains and hotels.

About the author ...

Javier Delgado is managing partner and EMEA CEO at Mirai.

Tags: BOOKING.COM, EXPEDIA, FACEBOOK, GOOGLE, HOTEL, ONLINE TRAVEL AGENCY, SEARCH TRAVEL PLANNING, ADVERTISING, CONTENT

.png?tr=w-780%2Cfo-auto)

.png?tr=w-780%2Cfo-auto)

.png?tr=w-780%2Cfo-auto)