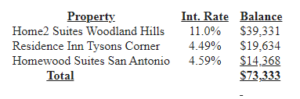

WEST PALM BEACH, FLA. – Chatham Lodging Trust, a hotel real estate investment trust (REIT) focused on investing in upscale extended-stay hotels and premium branded, select-service hotels, today announced that it has repaid in full three mortgages with outstanding principal of $73.3 million and a weighted average interest rate of 8.0 percent with proceeds from its newly issued term loan which currently carries an interest rate of 6.1 percent.

The Tysons and San Antonio loans were paid off at maturity, and the Woodland Hills loan was paid off early. Chatham has until late April to borrow funds under the unsecured term loan and intends to fully draw the $90 million within that time frame.

“With our recently completed unsecured revolving credit facility and term loan, we have the ability to smartly manage our maturing debt,” highlighted Jeremy Wegner, Chatham’s chief financial officer. “We are especially pleased to be able to refinance our high-rated Woodland Hills mortgage, further solidify our balance sheet and reduce our interest costs.”

Chatham Lodging Trust is a self-advised, publicly traded real estate investment trust focused primarily on investing in upscale extended-stay hotels and premium-branded, select-service hotels. The company owns 39 hotels totaling 5,914 rooms/suites in 16 states and the District of Columbia.

Tags: Chatham Lodging Trust