Always the optimists

We predicted that Summer 2022 would be a record-breaker despite ongoing global crises. The figures are in, and they're looking great. Finally free from the shackles of COVID, the pent-up demand for travel exploded. Airports, airlines and travel agents struggled to keep up with the massive influx of people desperate to get away for a week or two.

After some initial bumps in the road, travel facilitators quickly accommodated the uptick in eager travellers to produce results that exceeded the pre-pandemic golden age. Thankfully, the outbreak of Monkey Pox failed to live up to its predecessor. Although the virus is still making its way around the globe, it has proven to be far less contagious than COVID-19, so governments haven't reacted as strongly, which means no travel bans, lockdowns or mask mandates (so far). All good news, but do the naysayers still have a point?

The pessimists might be on to something

Since our last edition, the tragedy in Ukraine has continued, as does its effect on the global economy. Inflation is rampant, energy prices are skyrocketing, and many talking heads predict a very cold (or expensive) winter for most Europeans. In addition, they expect that travel demand will wane as inflation rises and reduces consumer purchasing power.

Figures taken from the travel price index (TPI), published by the U.S Travel association, give us a gloomy outlook if current inflationary trends continue.

According to July 2022's TPI, the main driver of inflation is the transport segment. The price of airfares rose as much as 27.7% over the same period as last year due to spiking fuel prices. Meanwhile, the prices of accommodation in EU member countries grew by a huge 19.2%. In addition, food and beverage services saw a yearly increase of 7.4%. All of this means the price of the average holiday has risen around 17%. As a result, would-be travellers are beginning to feel priced out.

In May 2022, 40% of Travelzoo Spain members who changed their travel plans said it was to choose a more affordable experience. So if prices go up even further, you can imagine more and more people will look for alternatives to travel.

Unless action is taken to prevent further inflation, these figures will likely grow as we approach 2023. And when most Europeans are choosing between 'heating or eating, will enough of us be able to afford a holiday to sustain the travel industry's growth? Perhaps many will realise it might be the last chance for an affordable holiday and we could see a despirate scramble for getaways before the impending economic crisis

Do we need a fortune teller?

We can try to predict the future with good or bad forecasts, but as we have seen, the market can react unpredictably. For example, the fear of a cold winter may fire up demand for travel to sunnier climes, just as travel restrictions allowed domestic travel to flourish. Additionally, the Work From Home trend is evolving into the Work From Anywhere movement, which could bolster traveller numbers during the coldest months of winter. As a result, we are optimistic that although growth might slow due to inflation, we don’t foresee the same negative trends which the pandemic brought.

So unless COVID-19 raises its ugly head from a summer of slumber and forces governments to take restrictive action, or the war explodes out into the rest of the world, we remain forever the optimists. As a wise man once said, “the past is history, the future is a mystery, and today is a gift, and that’s why we call it the present”.

So, let’s not despair about what we don’t know, celebrate this summer’s booking bonanza and take a deeper look at the numbers behind the records.

Looking at the last two months and comparing them to the same pre-pandemic period. What do the trends say?

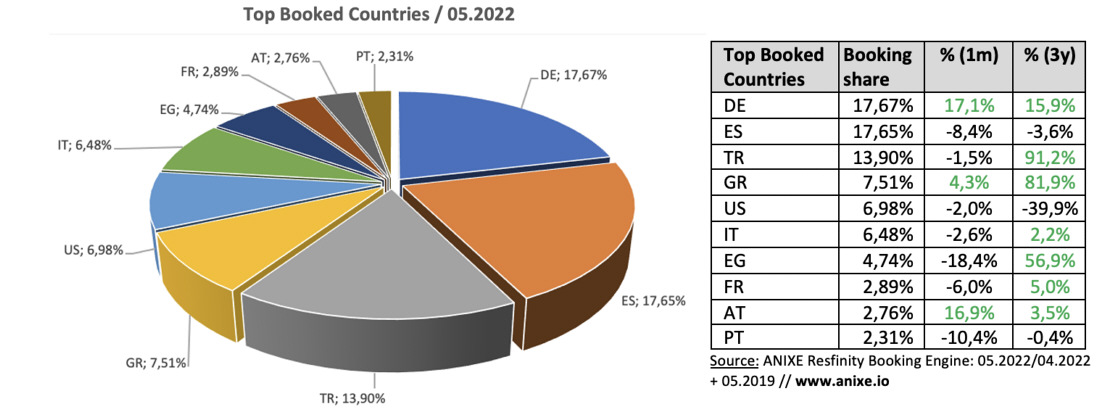

The last two months have seen the continuation of a mega-positive trend in which turnover has exceeded 2019 levels. May 2022 generated a record level of bookings with a 15% monthly increase. The value achieved the 145% scale of growth compared with 05.2019.

Recent months have seen the continuation of a steady positive trend, with turnover exceeding 2019 levels. August 2022 generated a 4% increase in monthly bookings. A value perhaps not as spectacular as in May 2022, when the jump was 15%, but the value remains 6% higher than the same period before the pandemic began. This is good news for the travel sector, especially since the trend of full market recovery compared to the pre-pandemic period has continued for nearly six months. This proves that the war in Ukraine, the pandemic and rising inflation - which certainly affects the number of travellers - cannot force people to cancel their vacations.

In August 2022, Germans booked Spain, Turkey, Greece and domestically. The latter, although its popularity has declined slightly on a monthly basis, is still more than 30% higher than in the same period before the pandemic. In contrast, the opposite situation is true for Spain and Turkey. Demand for the destinations, although already high, has increased even more.

On the other hand, despite being one of the more popular destinations, the United States saw its share of demand fall and remain 40% lower than before the pandemic.

In August 2022 - as in previous periods - German travellers were most likely to book hotel rooms in the Spanish resorts of Palma Mallorca, Turkey's Antalya, and Egypt's Hurghada. The first two enjoyed a significantly higher interest in August than in July 2022. Although in the case of Antalya, this figure is still nearly 22% lower than in the August before the pandemic.

Popular domestic destinations such as Berlin, Munich, Frankfurt, and Hamburg remain in the lead but saw an average monthly decline of more than 10%. Particularly the capital of Bavaria, which in July, had enjoyed a relatively high demand, 65% higher than before the pandemic.

The most popular destination cities in August 2022 were Berlin, Hurghada and Side. Although their share dropped slightly, they remained top among the most popular cities.

Compared to the pre-pandemic situation in August 2019, Hurghada saw the most significant (33%) increase in destination popularity. On the other hand, the most significant declines in the share of the ten top-rated destinations in the Resfinity Booking Engine were for London and Playa de Palma by 120% and 330%, respectively.

Traditionally, German travellers prefer trips lasting about a week. Situational instability resulting from Covid, the war and escalating tensions in Eastern Europe are prompting travellers to make shorter but more frequent trips. Day stays are the most popular, even surpassing week-long holidays in popularity in recent months. Compared to 2019, we additionally see a sharp decline in trips lasting more than 14 days, which may be related to rising inflation. On the other hand, trips of two days, 5-6 days and 9-10 days recorded slight increases.

In August 2022 - like three years ago - interest in early booking offers (31-60 days and above) dominated, outclassing bookings made 0-7 days in advance. The uncertainty of the current times means that interest in last-minute offers for fall and winter dates is waning both on a monthly and 3-year basis. Experience from previous periods shows that autumn AND winter are unsuitable for travel planning.

The trend showing the profile and size of the statistical traveller group is also confirmed for another straight month. Dominating are groups of 2 people and singles. Surprisingly, the share of single bookings in August 2022 was 13% lower than in August 2019. The unabated popularity of remote working and reduced business travel have certainly played a role.

ANIXE's Resfinity travel industry data shows that the large share of 1-2 person trips coincides with the overwhelming popularity of rooms with breakfast. Although their share fluctuated by nearly 5% monthly, their popularity is still 17% higher than in August 2019. Quantitatively, Half Board meals scored the most significant increase, with a share of 11.23% in overall bookings.

As for prices, there is a noticeable steady increase in prices both monthly and, of course, compared to pre-pandemic levels. Particularly in the German market, a price increase of 14% per person on average is noticeable, which differs from that observed globally. On the one hand, this results from the hotel sector's desire to make up for losses as prices react to changes in demand and the high holiday season. But above all, rising inflation, which is weighing down on the European economy, is significantly affecting price differences.

The summer holiday season brought the expected boom to the tourism market. However, the positive mood is being dampened by negative factors related to the war in Ukraine and various sanctions and restrictions that significantly impact local and global markets. In addition, inflation driven by rising fuel, energy and food prices is increasing prices in the tourism sector and limiting tourists' economic opportunities.

Data origin: ANIXE Resfinity Booking Engine. (Complete report available at anixe.io).

Data originated from the ANIXE Resfinity IBE system.

Tags: ANIXE