The short-term rental (STR) sector was once the pandemic-era darling—offering privacy, safety and space when travelers needed it most. But now, as the dust settles, its place in the lodging landscape is less assured.

Usage among United States leisure travelers has plateaued at around one quarter of the market since 2020, according to Phocuswright's recent report: U.S. Short-Term Rentals 2025: Guest Attitudes and Decision Making. That stability may appear promising, but it also masks a deeper issue: stagnation.

While Airbnb continues to post strong earnings, the category overall is grappling with reputational drag fueled by viral headlines, uneven guest experiences and rising scrutiny from the next generation of travelers

“While rental guests express high satisfaction rates with recent stays—85% rated it a four or five on a scale where five represents total satisfaction, on par with their recent hotel stays—they are not loyal to the category exclusively,” said Madeline List, author of the report and manager of research and special projects for Phocuswright.

“In addition to their STR stays, 68% of rental guests also stayed in a hotel and 18% in a resort. These travelers are highly cognizant of hotel standards and compare the two types of accommodations in both shopping processes and the stays themselves.”

Younger guests—those under 35—are showing signs of skepticism. They're less likely to see STRs as offering the best overall stay and they’re more sensitive to negative press. They're also less convinced that rentals deliver real value for money, despite the category’s advantages in space, amenities and flexibility. If these perceptions persist, future growth is at risk.

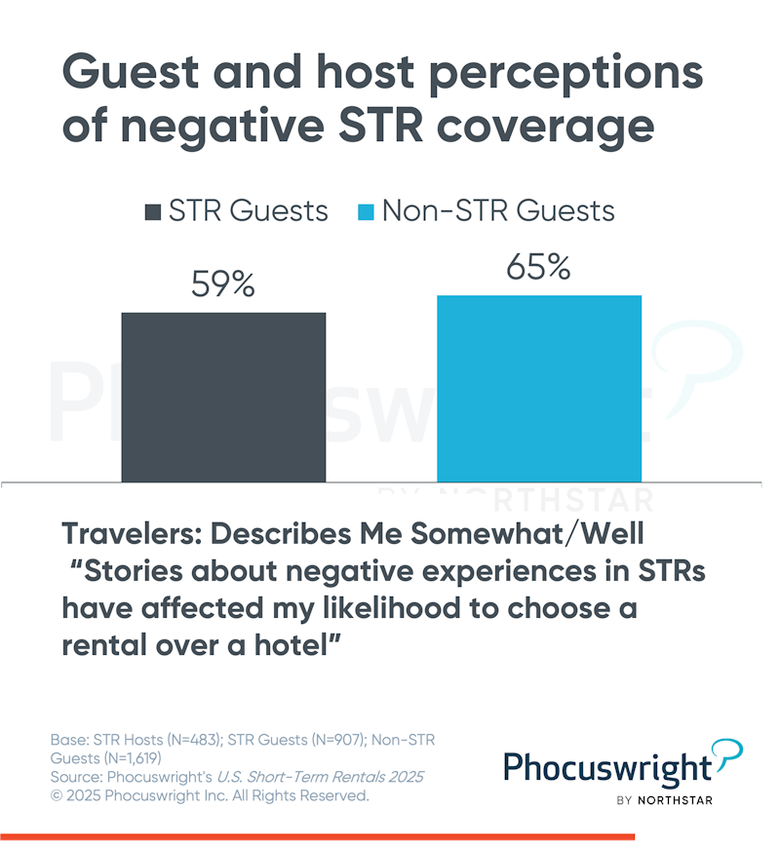

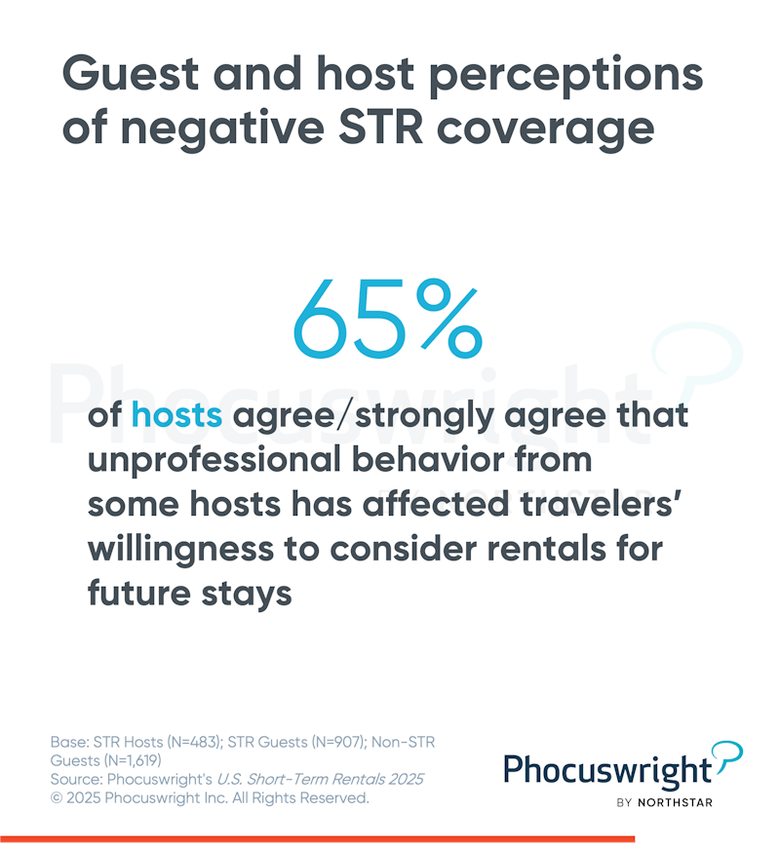

At the same time, hosts themselves recognize the problem. A majority agree that unprofessional behavior across the sector is eroding consumer trust. And when nearly two thirds of guests—regardless of whether they’ve stayed in a rental recently—say that negative stories have impacted their decision-making, the message is clear: Public perception matters as much as product delivery.

“As guest expectations continue rising to mirror those of hotels, many property managers (PM) expect to see a fallout in the competitive scene,” List said. “Properties that hold themselves to the highest standards are expected to win more guests, especially in a market saturated with rental inventory. Those who cannot rise to the challenge are at greater risk of financial failure and exiting the market.

“But some of the hosts who are more likely to notice the rising expectations are also those who struggle with other areas of their business. These include hosts who are not aiming to profit from their STR business and those who have outsourced management to a PM.”

The STR industry isn’t just maturing—it’s under pressure to evolve. Transparency, consistency and reputation management are no longer optional; they are the levers of future relevance. In a crowded marketplace, the ability to shape perception may be just as critical as what you build behind the front door.

“A stable portion of leisure travelers are staying in rentals in recent years, though their frequency of category usage and amount spent on these accommodations may have fluctuated,” List said. “The vast majority of travelers who use rentals have been pleased with their recent stays, but significant issues persist that will need to be addressed in order for STRs to make further inroads on hotels."

Phocuswright's U.S. Short-Term Rentals 2025

Tags: Phocuswright, U.S. Short-Term Rentals, STR