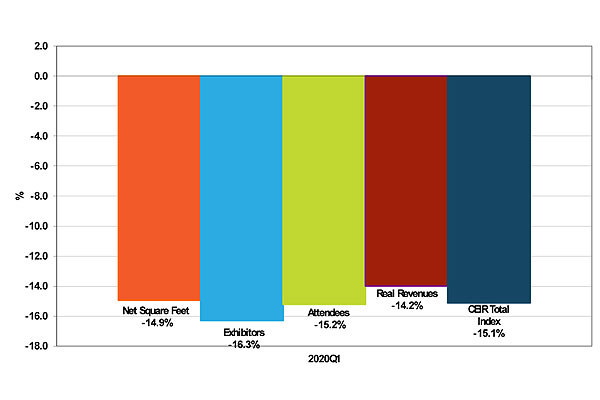

DALLAS – The Center for Exhibition Industry Research (CEIR) reports that growth of the exhibition industry plunged during the first quarter of 2020 as 72.6% of events originally scheduled for the second half of March were cancelled. The remaining 27.4% of events were postponed and some of those events may eventually be cancelled as well. As a result of many cancellations, the CEIR Total Index, a measure of exhibition industry performance, registered a record 15.1% decline from a year ago (see Figure 1), compared to a modest 0.3% year-over-year gain of inflation-adjusted GDP (see Figure 2). The latter had been somewhat buffered by continued opening of essential businesses and online purchases.

Figure 1: Quarterly CEIR Total Index for the Overall Exhibition Industry, Year-over-Year Growth, 2011Q1-2020Q1

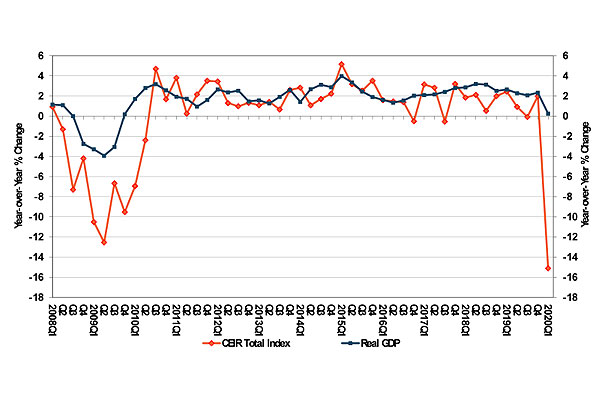

Figure 2: Quarterly CEIR Total Index for the Overall Exhibition Industry vs. Quarterly Real GDP, Year-over-Year Growth, 2008Q1-2020Q1

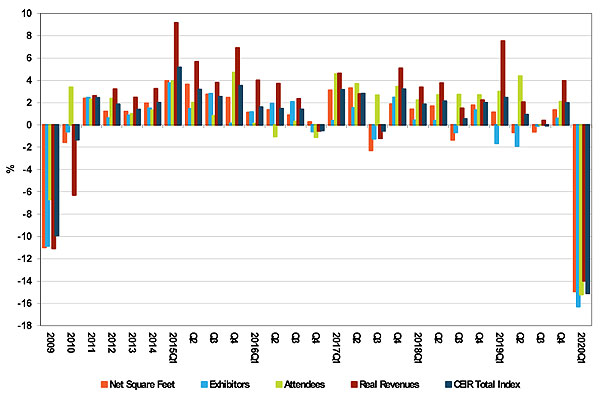

All exhibition metrics in the first quarter posted sharp year-over-year declines (Figures 3 and 4). Exhibitors and attendees posted the largest drop of 16.3% and 15.2%, respectively. Net square feet (NSF) decreased 14.9% whereas real revenues (nominal revenues adjusted for inflation) tumbled 14.2%.

Were it not for the start of the pandemic crisis, the exhibition industry was poised to continue growth as forecasted. Excluding the cancelled events in March, the Total Index grew by a modest 0.3%. All exhibition metrics except exhibitors posted moderate year-over-year gains. Real revenues rose 1.0% and both NSF and attendees increased by a modest 0.7%. Exhibitors declined 1.0% from a year ago.

Excluding cancelled events, Government; Transportation; and Industrial/Heavy Machinery and Finished Business Inputs all registered robust year-over-year gains. In contrast, Building, Construction, Home & Repair; Discretionary Consumer Goods and Services; and Raw Materials and Science posted year-over-year declines.

“Prior to the lockdown, the fundamentals of the exhibition industry were in good standing as the growth of exhibitions continued,” said CEIR Economist Allen Shaw, Ph.D., Chief Economist for Global Economic Consulting Associates, Inc. “Social distancing will remain a challenge for the exhibition industry for the remainder of the year.”

Figure 3: Quarterly CEIR Metrics for the Overall Exhibition Industry, Year-over-Year Growth, 2020Q1 Figure 4: Quarterly CEIR Metrics for the Overall Exhibition Industry, Year-over-Year Growth, 2009-2020Q1

Figure 4: Quarterly CEIR Metrics for the Overall Exhibition Industry, Year-over-Year Growth, 2009-2020Q1

“The exhibition industry is a key business driver for hotels, airlines, restaurants and ground transportation as well as for the broader U.S. economy. In 2019, the industry contributed more than $101 billion to U.S. GDP. It is incumbent for Federal financial rescue programs to extend to event organizers and service providers so that the exhibition industry can help buoy economic recovery by helping keep businesses alive and help people keep their jobs and put millions of people back to work,” said CEIR CEO Cathy Breden, CMP, CAE, CEM.