ATLANTA – The U.S. lodging industry is forecast to enjoy continued levels of record occupancy through 2019. If achieved, this will mark a 10-year period of uninterrupted growth in this key industry metric, something U.S. hoteliers have never experienced in the past 86 years. Based on the recently released December 2017 edition of Hotel Horizons, CBRE Hotels’ Americas Research is forecasting the annual average occupancy rate for U.S. hotels to hit 65.9 percent in 2017 and essentially remain at this level through the end of the decade.

“Given the encouraging signs concerning the domestic economy, continued increases in lodging demand and the measured growth in supply, occupancy levels are expected to remain at their peak in the years ahead,” said R. Mark Woodworth, senior managing director of CBRE Hotels’ Americas Research (CBRE). “CBRE Research expectations for U.S. gross domestic product, employment and income growth for the next two years should support lodging demand growth of two percent or more per year, which slightly exceeds our expectations for the net increase in supply over this period. If we continue to see upgraded expectations for the economy, demand growth may exceed these expectations, and all industry participants will benefit as a result.”

“Using terminology from my colleagues in the physics department, the U.S. lodging industry reached its ‘escape velocity’ back in 2014,” said John B. (Jack) Corgel, Ph.D., professor of real estate at the Cornell University School of Hotel Administration and senior advisor to CBRE Hotels’ Americas Research. “U.S. hotels returned to their previous peak occupancy levels that year and arguably have moved to an even higher orbit with the record occupancy expected for 2017. Our forecasts show that hotels will sustain a very high level of performance. Looking at all the economic and market factors that could influence hotel performance in the future, if the industry were to jettison itself from its current glide path, the trajectory would more likely be upwards, not downwards.”

Challenges Exist

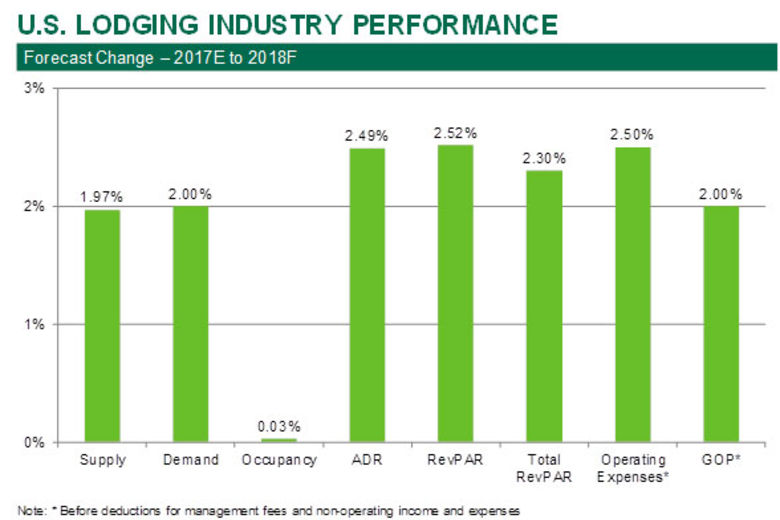

Despite the record occupancy levels, average daily rate (ADR) growth continues to challenge hoteliers. Factors such as increased supply growth, low inflation, the sharing economy, revenue management beyond RevPAR and book-direct, best-price guarantees all put downward pressure on the ability of operators to raise rates. For 2017, CBRE is forecasting an annual ADR increase of 2.2 percent, followed by 2.5 percent in 2018. Both measures are below the long-run average annual ADR growth rate of 3.1 percent.

Despite the record occupancy levels, average daily rate (ADR) growth continues to challenge hoteliers. Factors such as increased supply growth, low inflation, the sharing economy, revenue management beyond RevPAR and book-direct, best-price guarantees all put downward pressure on the ability of operators to raise rates. For 2017, CBRE is forecasting an annual ADR increase of 2.2 percent, followed by 2.5 percent in 2018. Both measures are below the long-run average annual ADR growth rate of 3.1 percent.

“Low ADR growth could have an impact on the profitability of hotels. With compensation costs rising more than 4.0 percent, hoteliers may not be able to sustain the growth in profit margins observed the past seven years. On average, hotels still should be able to enjoy gains on the bottom-line, but the flow-through will not be as efficient,” Woodworth noted.

Look Local

As hotels finalize their 2018 budgets, it is important for owners and operators to understand their local market conditions. Previous research conducted by CBRE has found that 75 to 80 percent of a hotel’s performance is dictated by local economic and market factors. “We continue to see great diversity among the performance of the 60 markets in our Hotel Horizons universe. For 2018, approximately half of the markets are forecast to achieve real growth in RevPAR, but more than a half dozen will suffer actual declines in this important measure,” Woodworth said.

As hotels finalize their 2018 budgets, it is important for owners and operators to understand their local market conditions. Previous research conducted by CBRE has found that 75 to 80 percent of a hotel’s performance is dictated by local economic and market factors. “We continue to see great diversity among the performance of the 60 markets in our Hotel Horizons universe. For 2018, approximately half of the markets are forecast to achieve real growth in RevPAR, but more than a half dozen will suffer actual declines in this important measure,” Woodworth said.

Among the 31 markets forecast to achieve RevPAR changes below the projected 2.1 percent inflation rate in 2018, the average increase in lodging supply is 3.8 percent. Conversely, the remaining 29 markets forecast to see RevPAR growth greater than 2.1 percent will see their competition increase by just 2.7 percent. “Supply change continues to be a critical local market issue. Pipeline activity across the 60 markets we analyze is very polarized and is the major influencer of our forecasts for occupancy and ADR change. The good news is that supply growth in several of these markets moderates beyond 2018,” Woodworth concluded.