LUTON - As the leading American and Gulf carriers embroil themselves in an unfair competition debate, the next stage of the battle for global air passenger markets has commenced. Those airlines which are focused purely on traditional alliance models may have taken their eye off the ball as rapid changes take place, according to OAG, the market leader in aviation intelligence.

OAG presents its considerations for future international strategies in its new analysis report ‘The Fight for Global Markets – Is Three the Magic Number?’, to be launched at CAPA’s Americas Aviation Summit in Las Vegas (27-28 April 2015) by OAG’s EVP Data and Market Intelligence, John Grant.

John Grant says: “Alliances are no longer the only means of international competition. Increasingly joint ventures, equity stakes and less formal partnerships are being used, all of which challenge existing structures and operations. There are currently more airlines than can realistically exist and in a truly global market where barriers were eased, we would expect to see a consolidation of carriers.

“The global aviation outlook is transforming and there have to be changes to the business structure, the key players and shape of the industry. Alliances are not a long-term solution – they are a fixed solution which have run their course for many circumstances.”

International capacity for US carriers falls

OAG’s report explores how dominant airlines have arisen and considers the academic label ‘Rule of Three’, whereby many industries are dominated by three large players which compete alongside smaller market specialists.

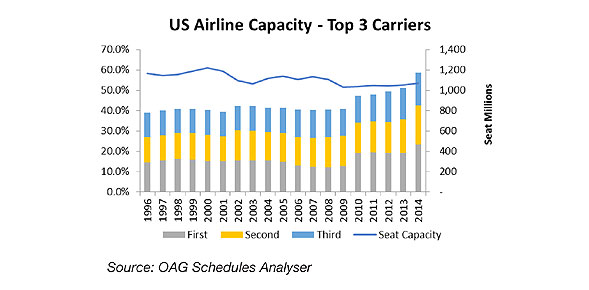

According to OAG’s Schedules Analyser, two thirds of domestic capacity is provided by the ‘big three’ US carriers, American, Delta and United, which together operate 59% of all US seat capacity, up from 37% nearly 20 years ago. With domestic capacity, this share becomes 62%.

Furthermore, these ‘big three’ airlines are ranked as the top three in the world with a combined share of 13% of global capacity. However, as industry consolidation has impacted supply, the total seat capacity in both domestic and international flights is 9% smaller today than it was in 1996.

Alongside market maturity has come some convergence of the business models. Low-cost carriers (LCCs) now provide over a quarter of capacity and when combined with the big three alliances, they account for 93% of US domestic capacity.

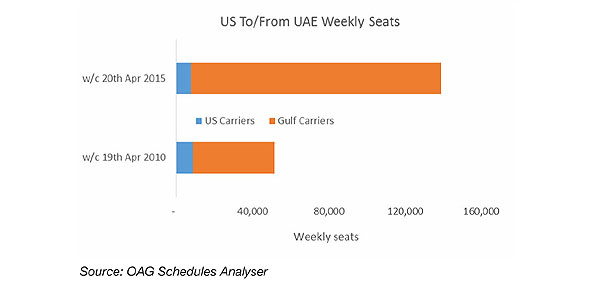

According to OAG’s report, whilst US carriers have developed international markets, those markets have been typically in close proximity to the US. At the same time, new carriers from further afield have successfully built scheduled services to the US. International capacity share for US carriers, of which the ‘big three’ account for 83% of seats, has fallen from 57% to 53%, as Gulf, Chinese and other carriers increase their respective shares.

In particular, looking at the US-UAE market, the US carriers have missed potential opportunities, according to OAG, as the Gulf carriers have sought new markets to serve from their hubs.

China to overtake US as world’s largest market by 2022

John Grant says: “While the target of the US concern has been Gulf carriers, it could equally have been Chinese carriers. Chinese airlines will operate 140% more seats to the US in a typical week in April 2015 compared to 2010. In contrast, the US carriers will have increased capacity by 80% in that time, leaving the US carriers with slightly more capacity on China-US routes. However, the Chinese carriers are closing in and within seven years China will have replaced the US as the world’s largest aviation market.”

LCCs as global leader contenders

LCCs are playing a major role in all markets, according to OAG. While their rapid growth makes them contenders to be global leaders, they have the wrong fleets to currently develop long-haul networks. OAG reports that the convergence between legacy and low-cost business models and common branding alongside joint ventures, such as AirAsia uses, might be the means to take this forward.

The future of alliances

According to OAG, while airline alliances have served a purpose, the merits of being aligned to a few major carrier brands can become outweighed by the need to be more flexible and to make strategic partnerships. Korean Air, a SkyTeam member, announced this year it will be code-sharing with American, a key member of Oneworld, highlighting how alliance members will still make decisions in their own best interests.

The US carriers, in highlighting the ASK growth of the Gulf carriers, have drawn attention to airlines with bases a long way off, yet still in a position to compete for traffic. Turkish Airlines, which ranks 11th in the world for ASK’s and ahead of British Airways in terms of seat capacity, is an airline which has developed from a niche carrier to a full service provider; with the benefit of a large domestic market and strategically placed hubs, it will continue to grow.

Future global players

OAG’s report concludes that China, Indonesia and Turkey might be the markets where three globally dominant airlines are based in ten years’ time, benefitting as they do from large domestic markets, growing economies and advantageous geographic position.