Published by leading travel retail research agency m1nd-set, a new research provides a detailed analysis of demographics, travel behaviour, purchase planning, and sustainability preferences. The research explores the shifts in product category preferences and purchase motivations, while highlighting regional differences, particularly in the wake of the Covid-19 pandemic. The travel retail research also assesses how decision-making moments have evolved and examines how key barriers preventing non-buyers from engaging in Duty Free shopping have changed over time. The evolutions are analysed from the pre-Covid era (2017 – Q1 2020) to the post-Covid recovery period (2021–2024).

Key Demographic Shifts

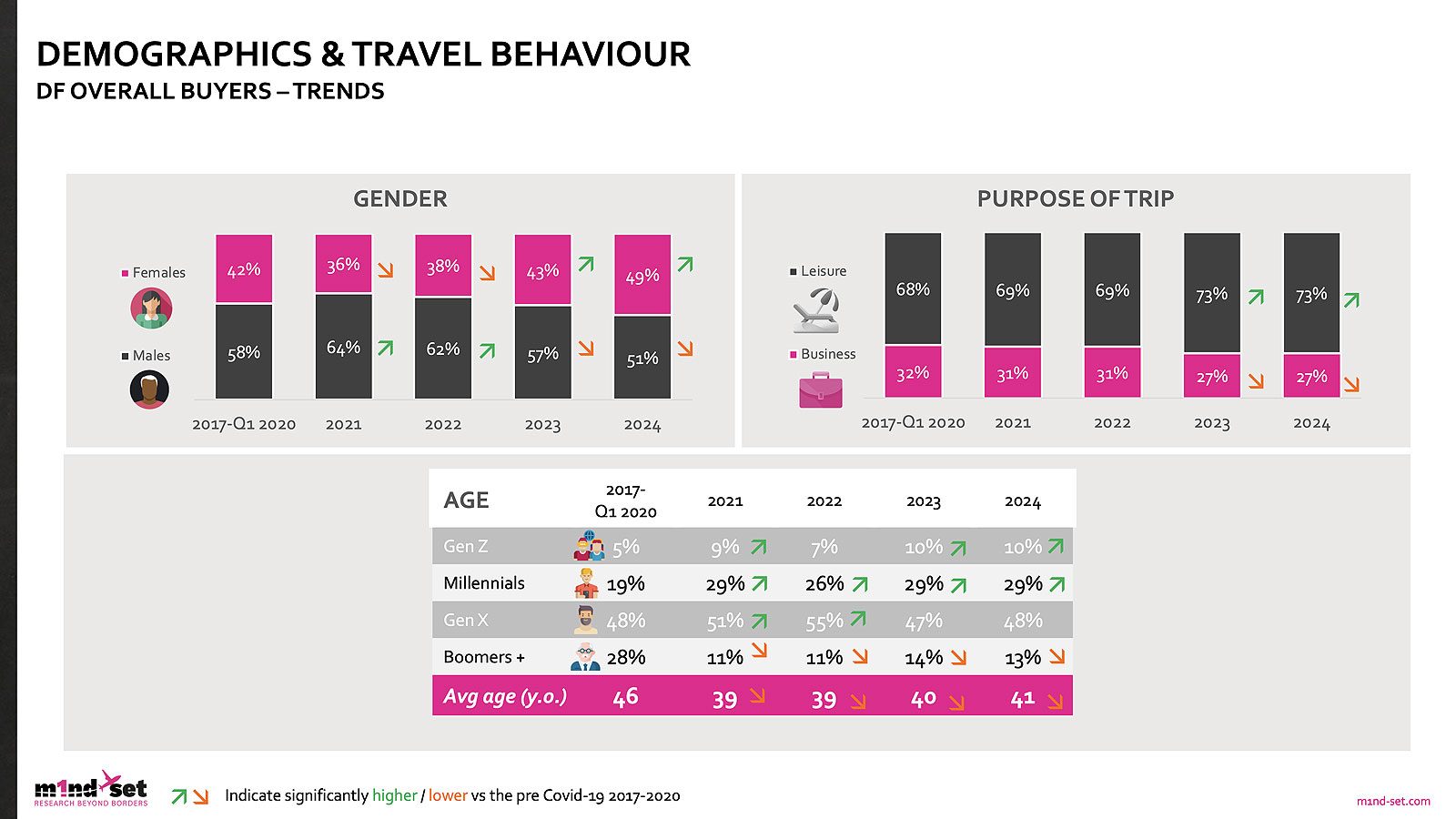

According to the m1nd-set Duty Free shopper demographics have transformed significantly from pre-Covid to post-Covid years. Younger travellers now represent a much larger share, with their

participation doubling from 5% pre-Covid to 10% in 2023 and 2024. Millennials have shown the most significant growth, rising from 19% pre-Covid to 29% in both 2023 and 2024.

Conversely, older travellers have seen a sharp decline, with Senior buyers dropping from 28% pre-Covid to just 13% by 2024. Middle-aged shoppers have remained relatively stable, settling at 48% of global Duty Free buyers. As a result, the average shopper age has decreased from 46 pre-Covid to 41 in 2024.

The gender composition of Duty Free shoppers has also shifted, m1nd-set reveals. Female buyers initially dropped from 42% pre-Covid to 36% in 2021 but have since risen steadily to 49% by 2024., Male buyers on the other hand, who peaked at 64% in 2021, now represent 51% of shoppers globally, according to the research.

Leisure travellers continue to dominate the Duty Free landscape among global buyers, increasing from 68% pre-Covid to 73% in 2024. Business travellers, in contrast, have seen their share decline

from 32% to 27% over the same period.

The research also demonstrates regional variations, highlighting some interesting outliers. Asia Pacific has a higher proportion of male buyers than the global average, while Africa & the Middle East show a greater share of female buyers. Millennials in Africa & the Middle East also comprise a significantly higher proportion than the global average, while Europe has a larger share of leisure travellers, according to m1nd-set.

Purchase Purpose and Planning

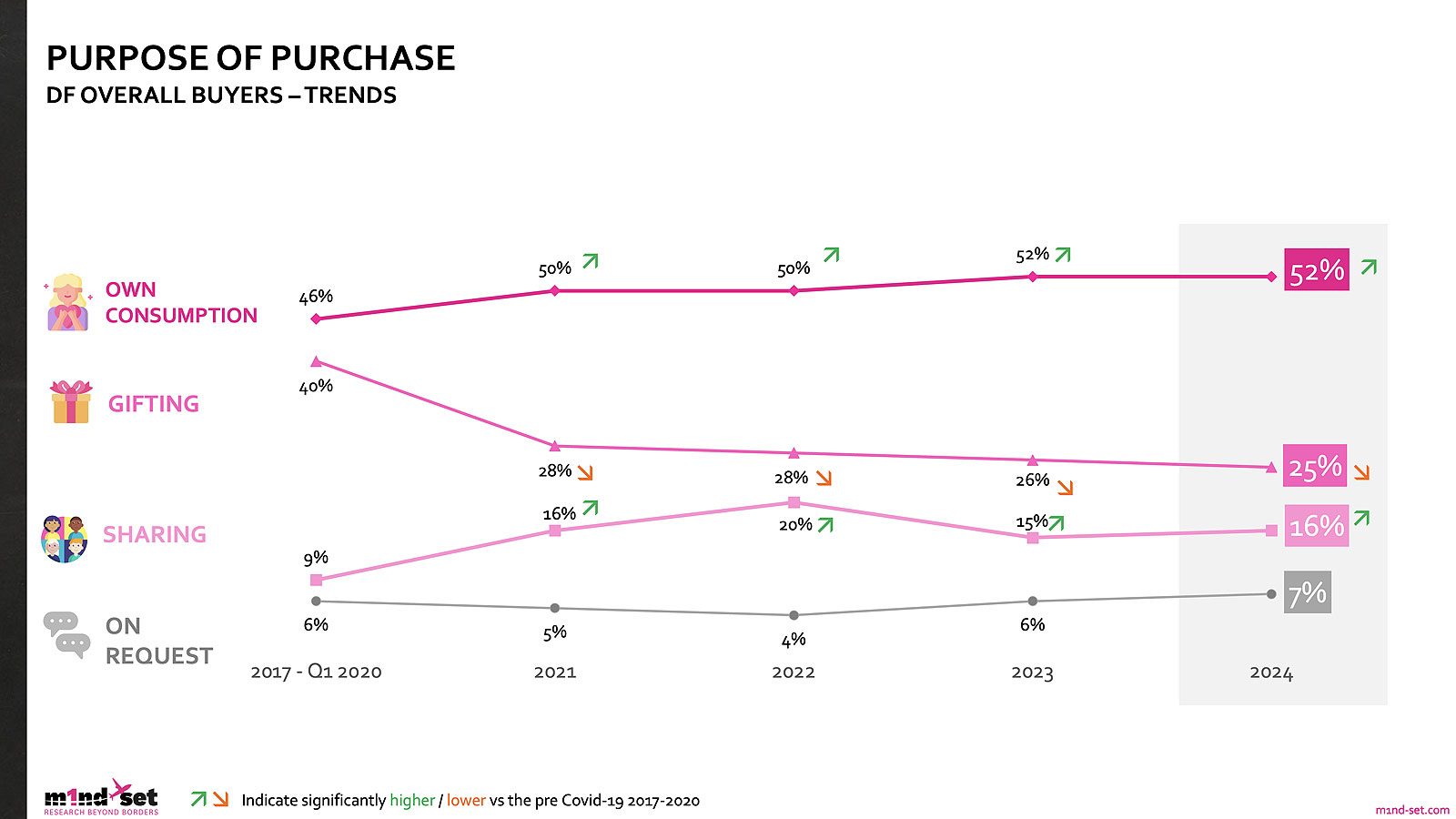

Gift purchasing has declined sharply since the pandemic, the travel retail research reveals, with only 25% of buyers purchasing for gifting reasons in 2024 compared to 40% pre-Covid. Meanwhile, purchases for self-consumption have risen from 46% to 52%, and sharing purposes increased from 9% to 16%. Impulse buying has seen a marked increase, rising from 21% pre-Covid to 28% in 2024, with Europele ading at 38%.

Purchasing and the Planet

Commenting on the need to align with the new, emerging shopper profiles, m1nd-set owner and CEO Dr. Peter Mohn said: “These shifts indicate a rapidly evolving Duty Free landscape, with younger, more eco-conscious, and leisure-focused shoppers redefining the market. Sustainability has become a key driver” Mohn continued, “with two-thirds of shoppers in 2024 prioritizing eco-friendly criteria, up from just over half in 2021. Younger generations, particularly Gen Zs, are spearheading this trend. It’s also hugely important to understand why browsers are not buying, Mohn added, and how these barriers to purchase have evolved over time. The research reveals that while price and limited product relevance remain the main barriers to Duty Free shopping, these have both declined since the pandemic. Price sensitivity has dropped significantly from 77% pre-Covid to 45% in 2024. To remain competitive and relevant, brands and retailers must prioritize sustainability and target younger demographics with marketing campaigns that resonate with Millennials and Gen Z shoppers and which focus on sustainability, exclusivity, and value-driven experiences” Mohn concluded.

Tags: travel retail, research, Peter Mohn m1nd-set